Appian (NASDAQ: APPN): 'Low Code' Compliance Software Enabling Russia's Regime

Opinion: Appian Corporation (NASDAQ: APPN) is a Strong Sell.

Key Points

- Appian positions itself as a "low code" application development solution with major F500 companies and many US federal government agencies among its customers. However, upon closer inspection it appears a large portion of Appian's revenue and operations in Europe come from Austrian bank Raiffeisen Bank, which has come under fire in Europe for being the only Western bank operating in Russia and for failing to implement anti-money laundering standards.

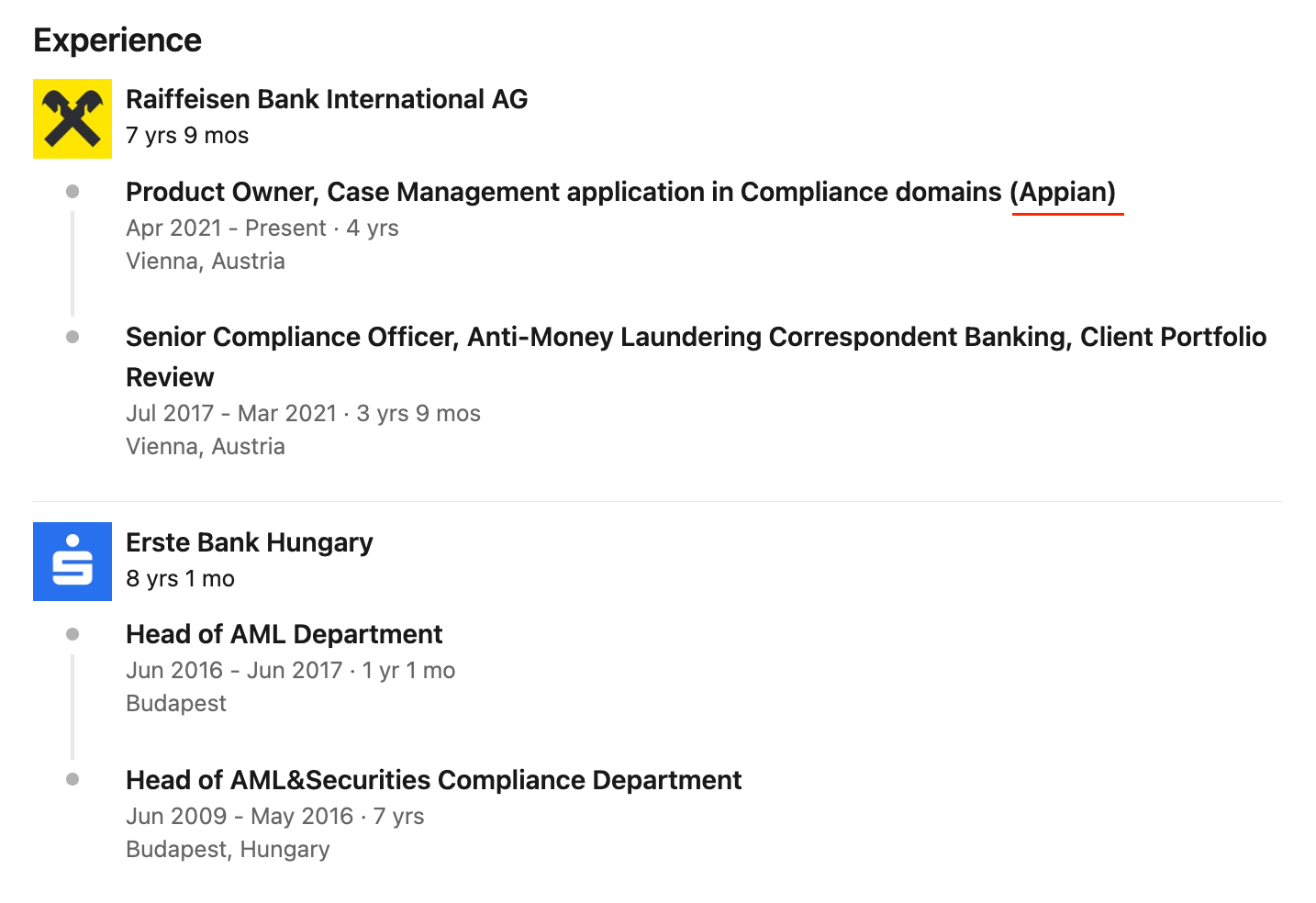

- Raiffeisen Bank's compliance and case management review process - which have recently been scrutinized in Europe - appear to have glaring omissions in order to support Russian money laundering into Eastern and Central Europe. As evidenced on Appian and Raiffeisen Bank materials, these processes at Raiffeisen Bank are built on Appian's "low code" software.

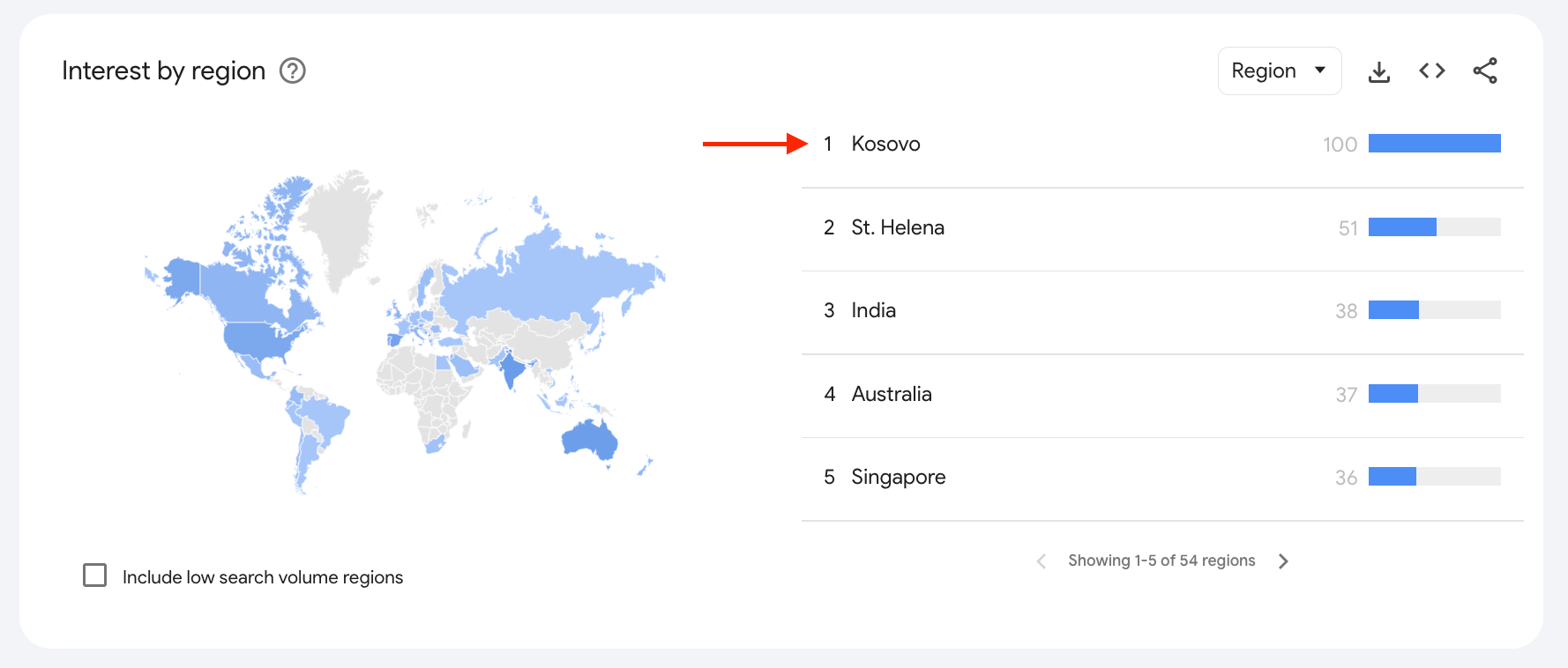

- Much of the Raiffeisen Bank Appian technology used to enable these Russian money transfers appears to be built in Kosovo through an internal transfer spin-off called Raiffeisen Tech.

- According to a recent Bloomberg, piece from just a month ago in February, Russia is currently holding €4.4 billion of Raiffeisen Bank's profits and Raiffeisen Bank has financed suppliers to Russia's military.

- Further, Raiffeisen Bank has participated in recent "show trials" in Russia, with Russian oligarchs fleecing this Austrian money laundering bank and locking up the money.

- Raiffeisen Bank's stock history is directly tied to the banking network's ability to move money for Russians. Upon Russia's invasion of Ukraine in February 2022, the bank's equity crashed. In May 2024, one Financial Times commenter Patrick Jenkins wrote that Raiffeisen Bank is a "rogue operator in Russia" and how its continued presence is an embarrassment to the West. As noted by this commenter in 2024, Raiffeisen Bank's profits are concentrated in Russia and Belarus, with around 69% of the banking network's profits coming from Russian and Belarusian activity. It is my strong opinion that the consumer banking and lending operations of Raiffeisen Bank in Europe are merely a front.

- In the current geopolitical climate, with Central Europe re-arming and Central Europe set to invest heavily in defense against Russia, I believe the Appian compliance pipelines that enable money laundering between Russia into Europe are at extreme risk of being shut down entirely. I believe Raiffeisen Bank may be forced to shut down entirely in a number of countries, including Poland, Germany, Czechia, Slovakia, and frankly anywhere that is not Austria or Russia.

- Appian's financial reporting became significantly more vague following Russia's invasion of Ukraine in 2022, with with absurd deletions of KPIs and metrics a lack of reporting on common software metrics like bookings and average contract value (ACV) just as the business claimed to be growing their cloud offerings revenue. Appian has also recently increased opacity around its customer count metrics. Historically, Appian disclosed total customer counts and subscription metrics allowing analysts to model and understand license and subscription sales, yet this was removed off the 2023 10-K. Even analysts present on recent Appian quarterly earnings calls have a difficult time understanding the metrics of this business, and this has come up as a point on recent call Q&A sessions.

- Appian's longtime Chief Financial Officer Mark Lynch, who retired in 2022, is now back in his role as Interim Chief Financial Officer as of late 2024. Mr. Lynch is known throughout the software investing world as the CFO of Microstrategy in the late 1990s and early 2000s responsible for Microstrategy's infamous revenue restatement in March 2000 that kicked off the broader dotcom bubble burst. Also along for the Appian revenue ride with Lynch is Stacy Dye, Appian's SVP of Revenue Recognition who previously held the same role at Microstrategy during Mark Lynch's infamous revenue restatement there.

- I strongly believe American investors are unaware of Appian's role in facilitating Russian money transfers in support of Vladimir Putin's military. Although we Americans like to see ourselves as the center of the world, our country has already become increasingly isolationist under Trump's new administration. I see no possibility that Central European powers will allow Raiffeisen Bank to continue their Russian operations, and I believe Appian (NASDAQ: APPN) to be a strong sell.

Raiffeisen Bank's Front Facing Story with Appian

This video, in German but subtitled in English, shows viewers a brief overview of the close relationship between Raiffeisen Bank and Appian, which this banking network uses for compliance and AML/KYC processes.

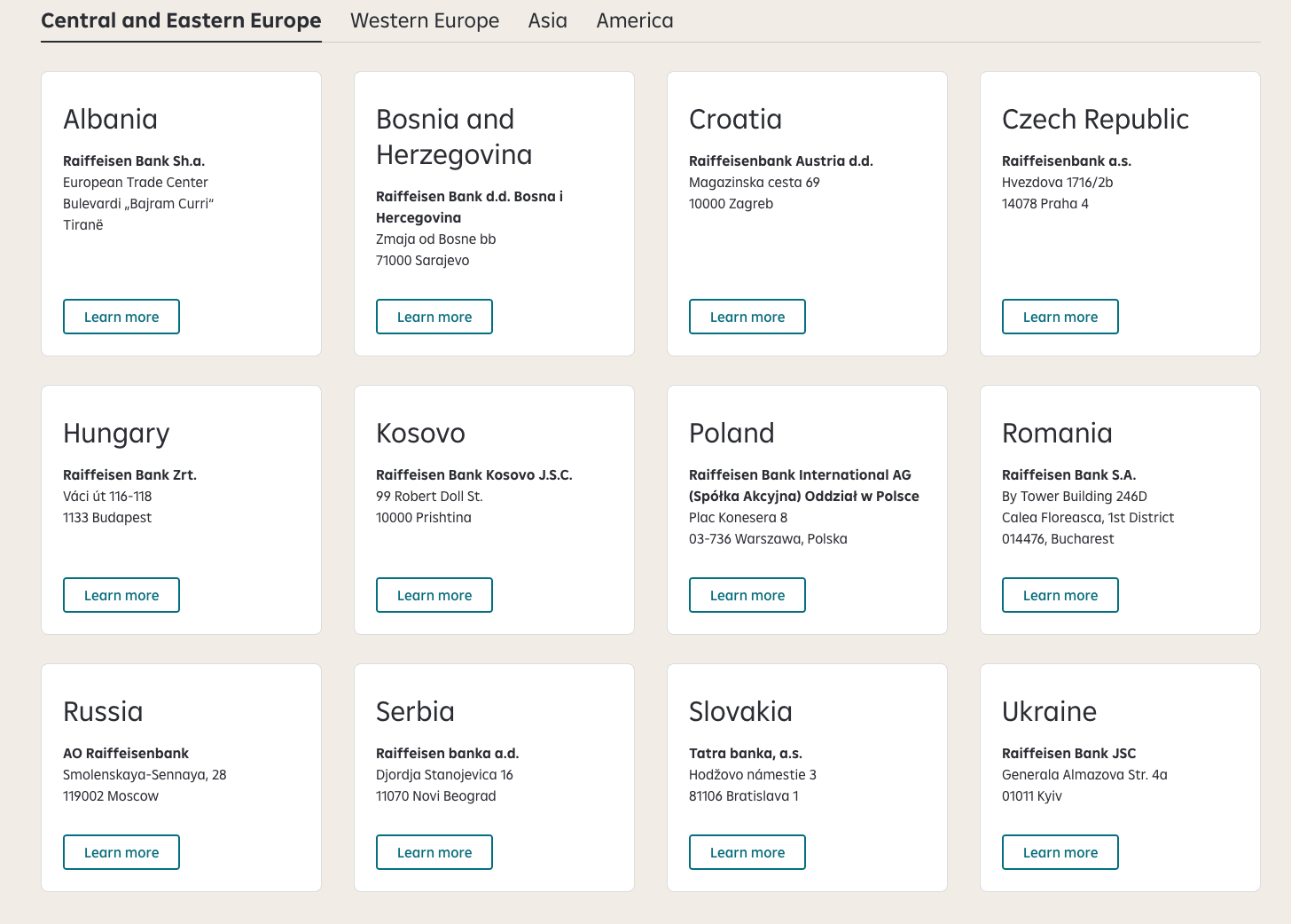

Raiffeisen Bank claims to be the business bank of Central and Eastern Europe (CEE). Yet underneath the hood this banking network is enabling Vladimir Putin's military and has for years operated money pipelines into and out of Russia.

Raiffeisen Bank presents itself as the bank of Central and Eastern Europe. Headquartered in Vienna, Austria the banking network operates in countries throughout the region to offer lending services, cash withdrawals, checking accounts, and many other standard banking services.

As part of the banking network's regular operations required to operate, Raiffeisen Bank implements a variety of compliance and case management processes.

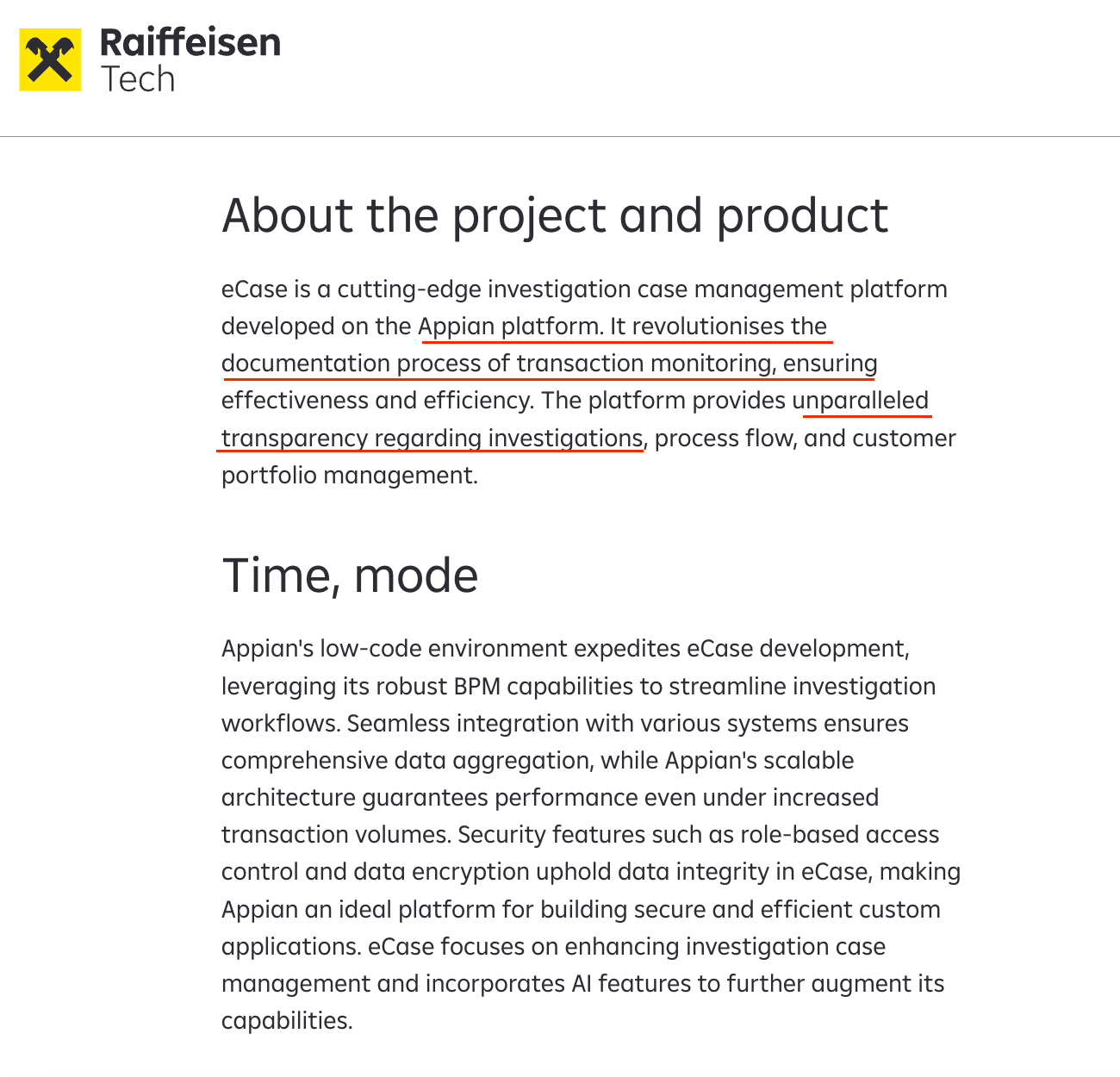

Raiffeisen Bank employs hundreds both in its Pristina, Kosovo tech center and in various countries of operation, all using Appian to manage these compliance processes to ensure bad and suspicious actors are monitored or kept out of the banking system. Per Raiffeisen Bank's tech hub website as of March 18, 2025, their custom Appian eCase platform built and managed through their Kosovo office promises:

- Unprecedented insight: Gain a comprehensive 360-degree view of compliance matters, consolidating all user research into one powerful tool.

- Empowered teams: Arm compliance team managers, officers, and other professionals with the tools to efficiently stream, share, and access relevant data, enhancing collaboration and decision-making.

- Seamless access: Effortlessly navigate through the wealth of information, ensuring swift access to critical data for informed actions and streamlined processes

Source. (Archived on March 18, 2025.)

Critics and financial watchdogs have recently raised been vocal about the bank's role in facilitating financial flows that circumventing international sanctions to enable claimed money laundering for Russian interests.

In what can only be described as a show trial that reportedly included armed Russians dressed in balaclavas, a Russian court in January 2025 imposed damages totaling over $2B euros against Raiffeisen Bank as the bank is currently being shaken down by Russia as the largest Western bank still currently in operation in the country.

As reported by Bloomberg in February 2025, Raiffeisen Bank has banked Russia's military suppliers, heavily via FX transactions from euros to rubles through Raiffeisen Bank, with Raiffeisen Bank reportedly generating over $1B in after-tax profits from its Russian operation in the first 3 quarters of 2024 with the bank's Russia business its most profitable subsidiary.

Raiffeisen Bank was also fined in June 2024 the largest penalty ever levied by Austria's Financial Market Authority (FMA) Austria after Raiffeisen Bank was found to have breaches in anti-money laundering and terrorist financing controls.

With Poland recently announcing a military training program for all Polish men, with Germany set to re-arm, with the United Kingdom announcing it is prepared to lead a multi-country coalition to deploy troops in Ukraine, and with the European Commission set to allocate $840B to re-arm European Union states, Raiffeisen Bank's continued operations in Europe are at extreme risk. It is entirely possible that assets of the bank's subsidiaries operating in several European Union countries could be seized altogether and operations halted.

Appian's Revenue Metrics Reporting Has Become Wonky in Recent Years

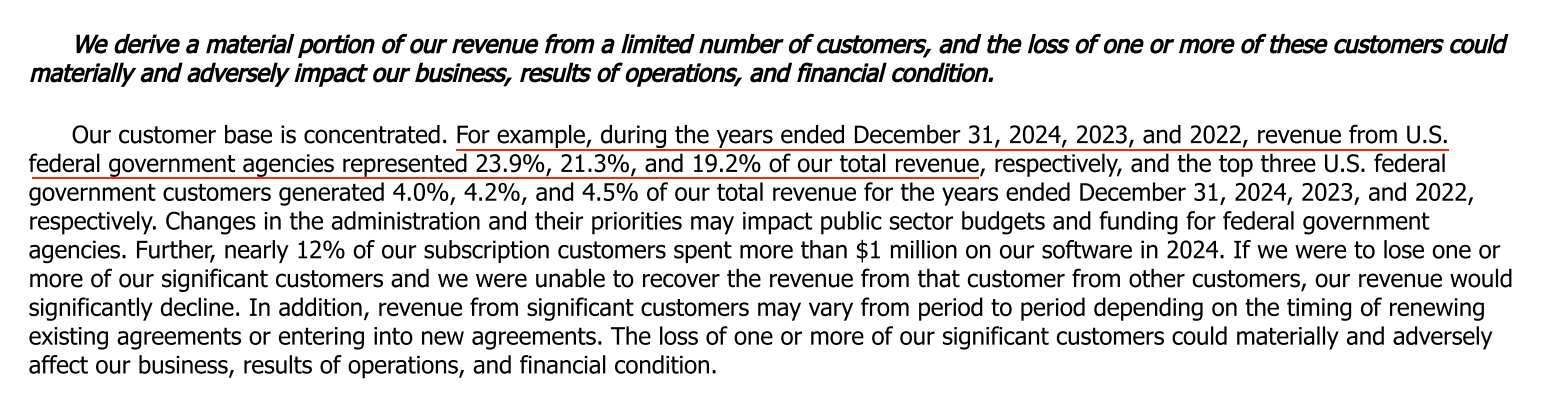

Appian has a pronounced customer concentration risk, not only among US federal government buyers but across the entire customer base.

Given the absolute number of Appian developers (remember: Appian is a "low code" platform) employed by Raiffeisen Bank per LinkedIn accounts and on Raiffeisen Bank's own websites, it is likely that the bank is among the largest customers of Appian outside of the US federal government by size of operation.

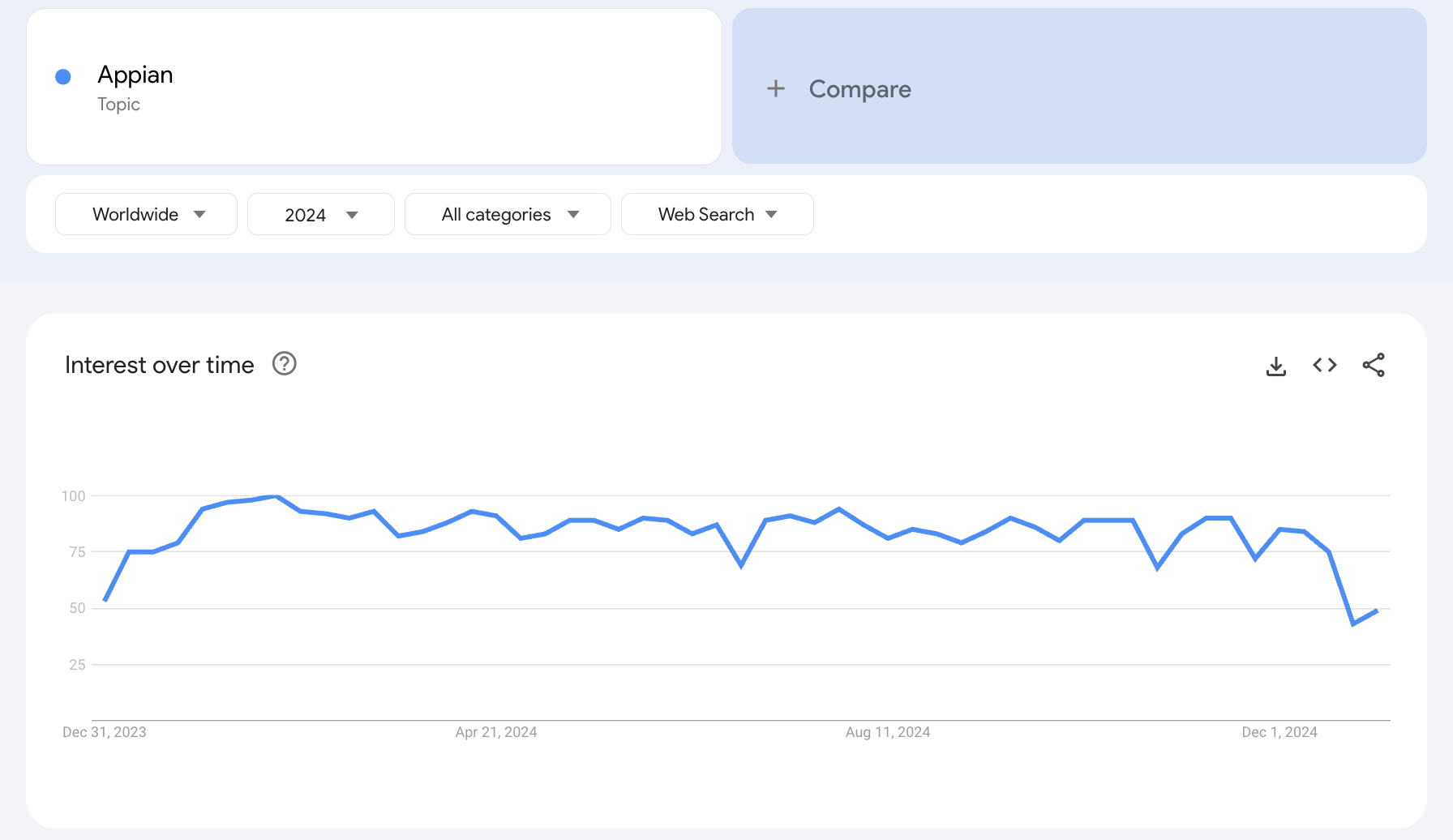

In fact, during the entire year of 2024, from January 1 through December 31 the #1 country for searching "Appian" as a topic according to Google Trends was Kosovo, which is home to Raiffeisen Bank's Appian development center, where case management tools are made for compliance for this banking network.

Below are disappearing customer count growth metrics on each "Key Factors" section of the past three 10-Ks, showing a trend of increasing lack of transparency.

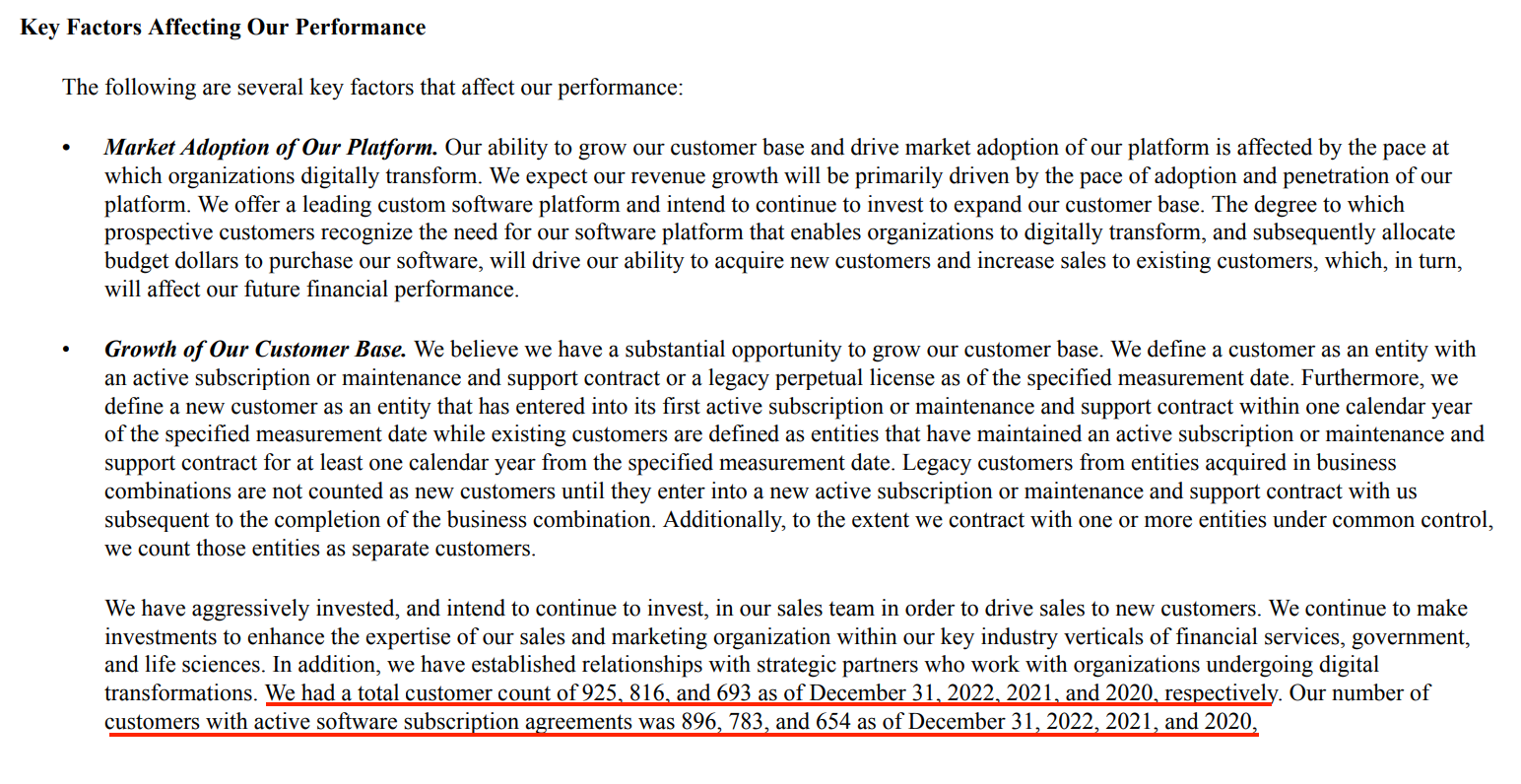

-FYE Dec. 31, 2022: Appian reported total customer counts of 925, 816, and 693 for each of the prior 3 years, as well as the number of customers with active software subscriptions.

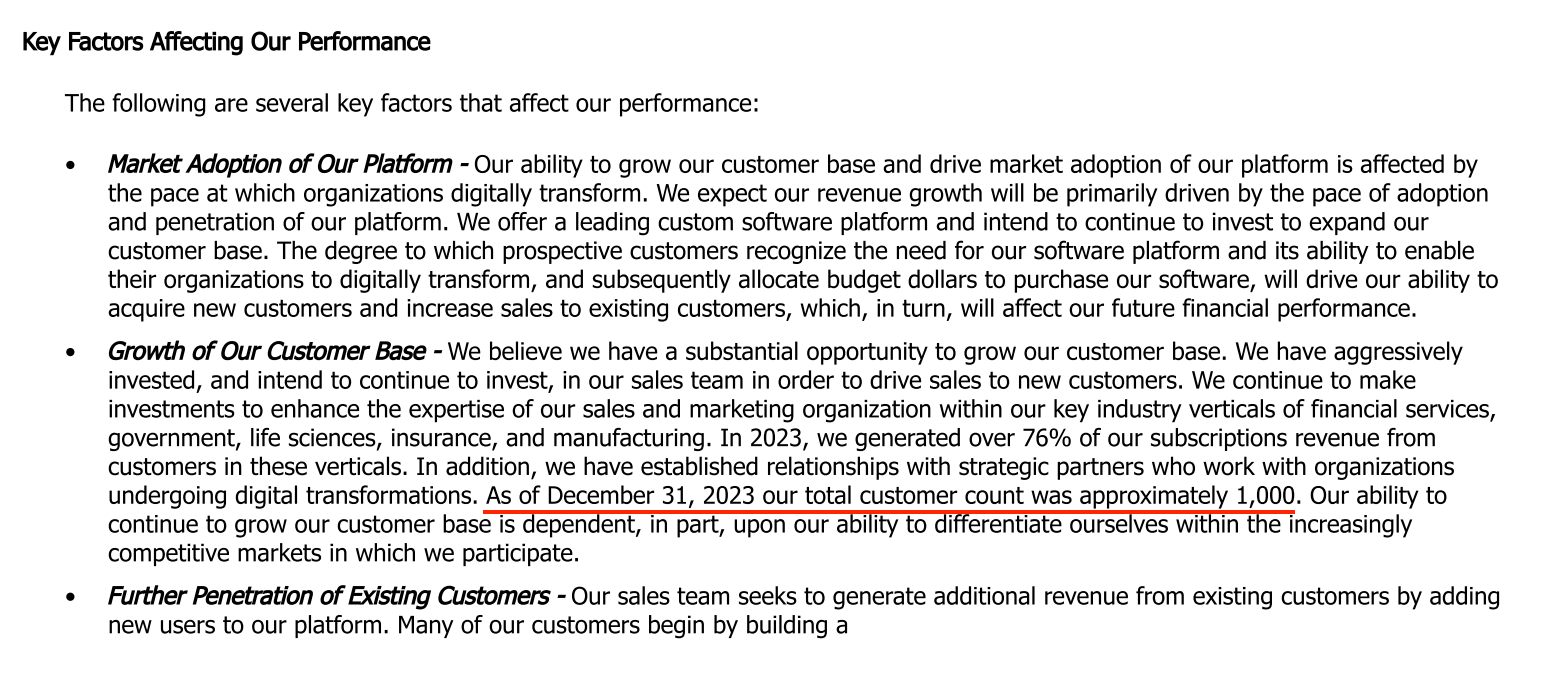

-FYE Dec. 31, 2023: Appian removed the hard numbers and reported "approximately 1,000" total customers

-FYE Dec 31, 2024: On the most recent 10-K delivered last month Appian has no total customer approximation and only reports on overall subscription revenue as a percent of revenue.

On the recent 10-K we see only a mention of "over 1,000" customers in the "Overview" section, which tells investors nothing compared to the previous year's "approximately 1,000" customer count.

Additionally, even as Appian has promoted their cloud product, Appian does not report on standard metrics found throughout the cloud computing and software industries, such as bookings or ACV.

I do not believe Appian is resonating with the broader market in the age of AI. As year-over-year logo growth seems to have stalled, Appian had become more reliant on federal government agencies under Biden's administration and customers such as Raiffeisen Bank.

Appian ridiculously claims on its recent 10-Ks that, "Due to the variability of our billing terms and the episodic nature of our customers purchasing additional subscriptions, we do not believe changes in our deferred revenue in a given period are directly correlated with our revenue growth."

Deferred revenue for a company like Appian is a great proxy for predicting revenue. Appian customers are clearly biased to do upfront billing on recurring subscription contracts. The inclusion of this note paired with the flattening of customer counts suggests a high level of customer churn issues or the anticipation of upcoming increases in churn issues.

It must be noted that Appian Chief Financial Officer Mark Lynch was previously the CFO of Microstrategy during its 2000 prior years revenue restatement and stock crash.

Appian CEO Matt Calkins' Stance of Publicly Decrying Vladimir Putin's Russia While Simultaneously Supplying a Solution that Enables Money Pipelines Between Europe and Sanctioned Russians is Unacceptable

Throughout 2022 Appian CEO Matt Calkins went on a publicity tour urging American software companies to permanently cease doing business with Russia in the wake of the Ukraine invasion.

In this April 2022 Yahoo Finance interview Calkins stated:

"Appian is a public software company that has chosen never to do business with Putin's Russia. And we are asking now that other technology companies, other public tech firms, make the same commitment and permanently stop doing business inside Russia. Right now, there's a lot of great gestures being made, and they're a start...Many companies have made a gesture that they're going to freeze or suspend doing business in Russia for the time being. They haven't announced when that might change. I believe they should go a step further. I think that's a good step, but they should go further. They should say, they will never do business in Russia while Putin is in charge there."

Calkins was also involved with site fight4ukraine.com which tracked sanctions and ongoing activity in Russia for several months before it stopped providing updates and he appeared on this Bloomberg podcast discussing how US software companies should cease doing business with Russia.

To call this performative would be an understatement as his firm Appian was providing and still provides software that allows Raiffeisen Bank to directly finance Russian efforts as the largest Western bank operating in Russia.

Conclusion

Appian (NASDAQ: APPN) is an increasingly risky stock as the company has clearly seen a slowdown in cloud revenue growth. Not only has Appian supported the financing of Vladimir Putin's regime via Raiffeisen Bank as Appian's CEO put on a show calling for US software companies to cease doing business with Putin's regime, but Appian is the provider of software used for compliance at this bank that is increasingly known in Central Europe and elsewhere for having poor compliance. As Central Europe re-arms under a looming Russian threat, I believe Appian will some under significant scrutiny not only in Europe but throughout its customer base.

________

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Lauren Balik does not represent the interests of any fund or of any investor other than herself. Past performance is not indicative of future results. This content speaks only as of the date published. Any projections, estimates, forecasts, targets, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.