AppLovin (APP) Has a ‘SuperBad’ Third-Party Gift Card Scheme Fueling Growth

Key Points

- APP has recently exploded in terms of equity value and in revenue growth, fueled by a strong push into e-commerce and a potential inclusion in the S&P 500, which did not occur.

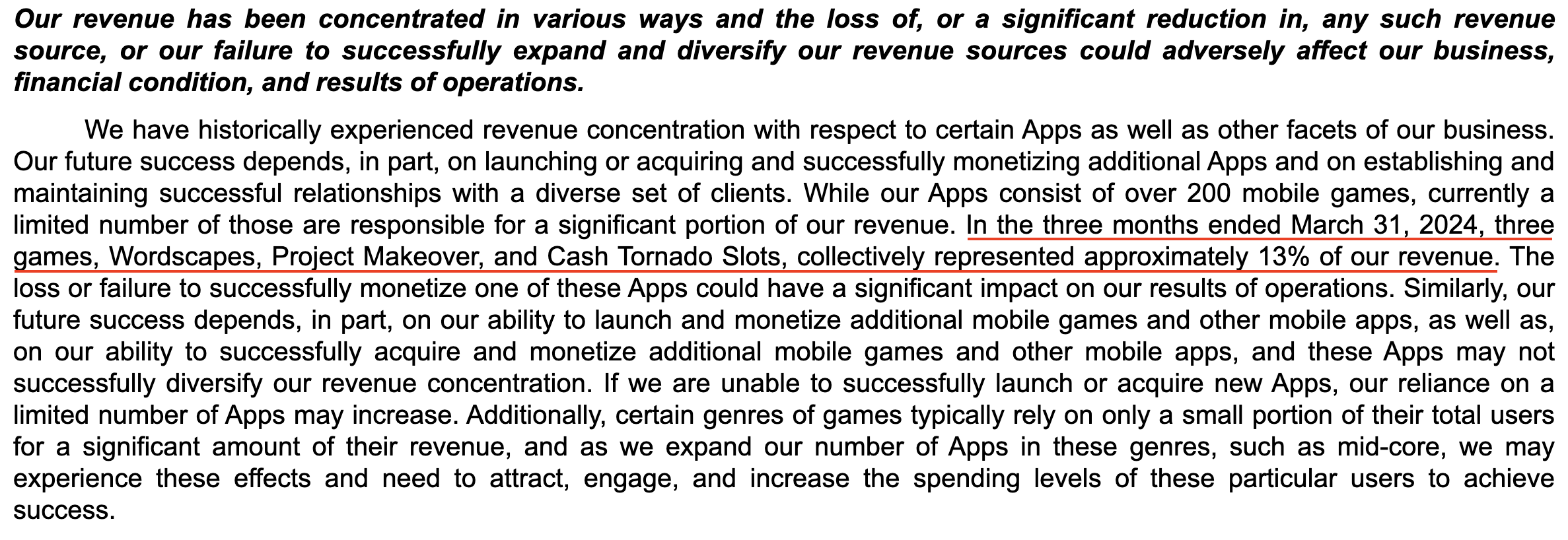

- However, incremental APP revenue and revenue growth through 2024 is heavily influenced by a number of “Get-Paid-To” third parties incentivizing mobile app users to get paid via PayPal, gift cards, or other incentives to play AppLovin and AppLovin partner games. In recent quarters 13% of APP's revenue was derived from 3 games, and through September 30, 2024, 9% of APP's 2024 revenue was derived from 2 games, all of which pay consumers to play APP's games. I found rampant cases of consumers being subsidized on a 1-1 ratio or worse for making in app purchases, flattering APP revenue numbers. In the most egregious case, this included a recent offer to make a $49.99 “in-app purchase” (IAP) on APP subsidiary game Cash Tornado Slots and receive $75.00 back in PayPal/gift card points. Games so big that APP mentions them in their 10-K and 10-Q filings are subsidized with PayPal and gift card points offers.

- I believe APP is the primary benefactor of this growing trend of “Get-Paid-To” mobile game usage. APP not only gets to boost revenue on IAPs for their own house brand games, but as APP controls the majority of ad mediation in the mobile gaming space, they benefit whenever a partner company uses “Get-Paid-To” mobile gaming programs paying consumers in PayPal or gift card points to watch as many ads as possible.

- APP’s recent surge in stock price is heavily built on an e-commerce retailer narrative, with APP currently involved with initial pilots with retail brands to bring them on the mobile games ad ecosystem. However, I do not believe this is scalable through the 2025 calendar year. If consumers are increasingly playing mobile games from APP studios or partner studios with an incentive to earn money or gift card points this channel becomes worse for selling to these consumers, as users are on APP games to earn money and not to spend money.

- Additionally, APP is competing heavily for ad budgets currently allocated to Meta, Google, and TikTok while APP is simultaneously the primary benefactor of mobile game ads on these platforms. If APP is to meaningfully take share, I expect significant pushback from Meta and TikTok on allowing APP to use it as an acquisition channel, just as we saw nearly a decade ago when Zynga (ZNGA) went public while being reliant on Facebook and competing for ad spend with Facebook. All it took was Facebook turning off notifications, deprioritizing games in its algorithm, and applying enough pressure to Zynga for ZNGA to collapse.

- I am short APP, as I am confident this e-commerce narrative falls apart throughout 2025 as the market realizes that APP revenue and usage is increasingly gamed with gift card giveaways and most mobile game ads are simply ads for other mobile games and there is no changing this in the short term. There's just nothing to be scaled here for advertisers outside of the mobile games circular revenue game.

Background

AppLovin is a mobile technology company operating a mobile app monetization and marketing platform in addition to running a number of their own mobile app games through numerous subsidiaries. The core business focuses on helping mobile game developers grow apps through a combination of marketing solutions, analytics tools, and monetization services.

At the center of AppLovin's business model and recent growth is their software platform, which leverages a “black box” machine learning solution to optimize mobile app monetization.

In recent months the stock has more than 5X-ed due to revenue growth, management’s narrative about expanding to e-commerce clientele, and the potential to list on the S&P 500, which did not pan out.

However, the mobile games space is seeing only modest revenue growth from in-app purchases (IAPs), with third parties noting that globally IAPs grew roughly 4% in 2024 vs. 2023. Additionally, downloads dropped 6% globally in 2024 vs. 2023.

Swagbucks, InboxDollars, and How APP Pads In-App Purchases and Ad Impressions

Of the more popular services that pay users to play mobile games are services run by a firm known as Prodege LLC, which runs Swagbucks, MyPoints, and InboxDollars among other services. Consumers are able to play games using the platform, and thus view required ads and/or make IAPs throughout the gameplay in exchange for PayPal or gift cards delivered to their email addresses.

"Broke?! This App [Swagbucks] PAYS When You Have No Money"

December 2, 2024

"🤑 How I’m Getting Paid to Play Games on My Phone! | Swagbucks Method"

January 13, 2025

While I expected that there would be some amount of subsidizing revenue for various games, I was shocked to find that a number of games were in fact clearly just tactics for washing money into gift cards or PayPal.

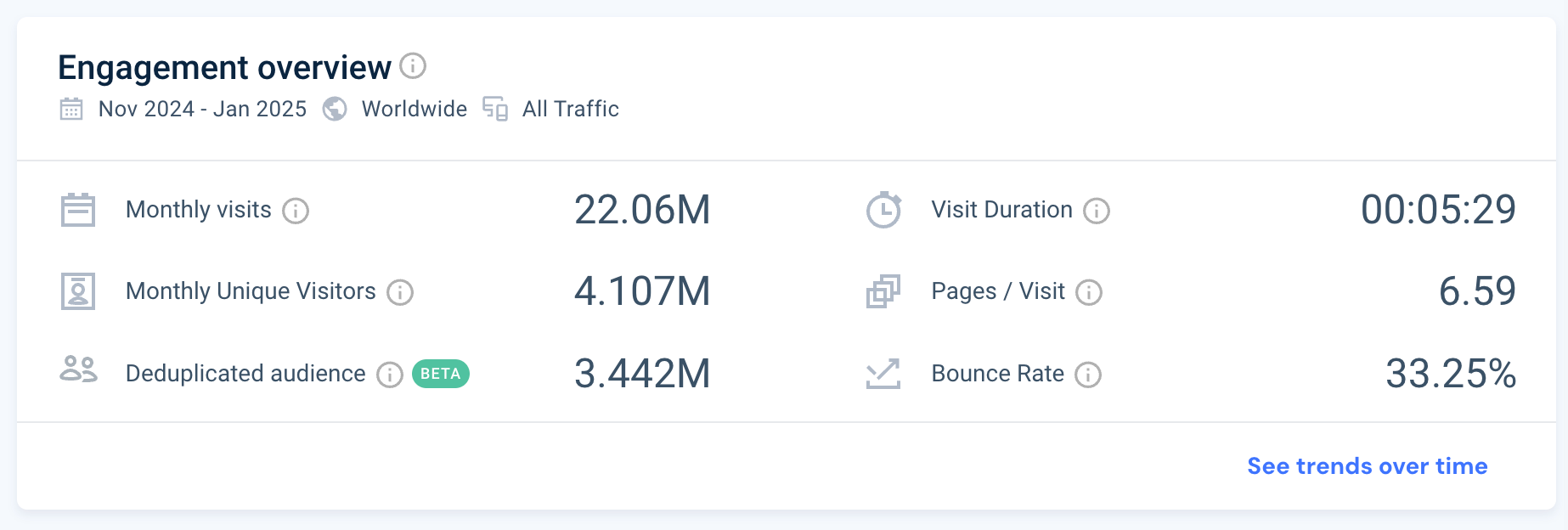

Swagbucks is no small potatoes, either. Per web traffic aggregator SimilarWeb, Swagbucks.com is the #537 most visited site in the United States for the three months of November 2024 through January 2025, with over 4M monthly unique visitors and over 22M monthly visits in this time period.

Let's dive into how APP is using this gift card/PayPal laundromat to drive revenue for both their own house brand games and APP partner games.

Case 1: Wordscapes and Project Makeover: APP's Cash Cow Games

Per AppLovin’s latest 10-Q for the quarter ending September 30, 2024, “In the nine months ended September 30, 2024, two games, Wordscapes and Project Makeover, collectively represented approximately 9% of our revenue.”

Per the 10-Q for the prior quarter ending June 30, 2024, “In the six months ended June 30, 2024, two games, Wordscapes and Project Makeover, collectively represented approximately 10% of our revenue.”

Both of these games that are so critical for AppLovin’s revenue that they are included by name in Risk Factors have Swagbucks and InboxDollars offers subsidizing revenue to the point that consumers were getting 1:1 gift card points back for the money they spend in game.

Here is the live link from August 21, 2024 and here is the archived version.

This Project Makeover game payment schedule via Swagbucks in Q3 2024 is further confirmed on a Reddit post from August 31, 2024. The live link is here and the archived version here.

Protege's other site InboxDollars was even running a promotion on the game as recently as October 9, 2024.

Wordscapes has been part of this “Get-Paid-To” trend as well, recently appearing on site Fetch Play offering gift card payments for playing Wordscapes, although Wordscapes appears to not be live on Fetch Play app as of February 8, 2025.

In the past, Wordscapes has appeared on Swagbucks and other “Get-Paid-To” sites.

Case 2: Cash Tornado Slots: APP's Other Recent Cash Cow

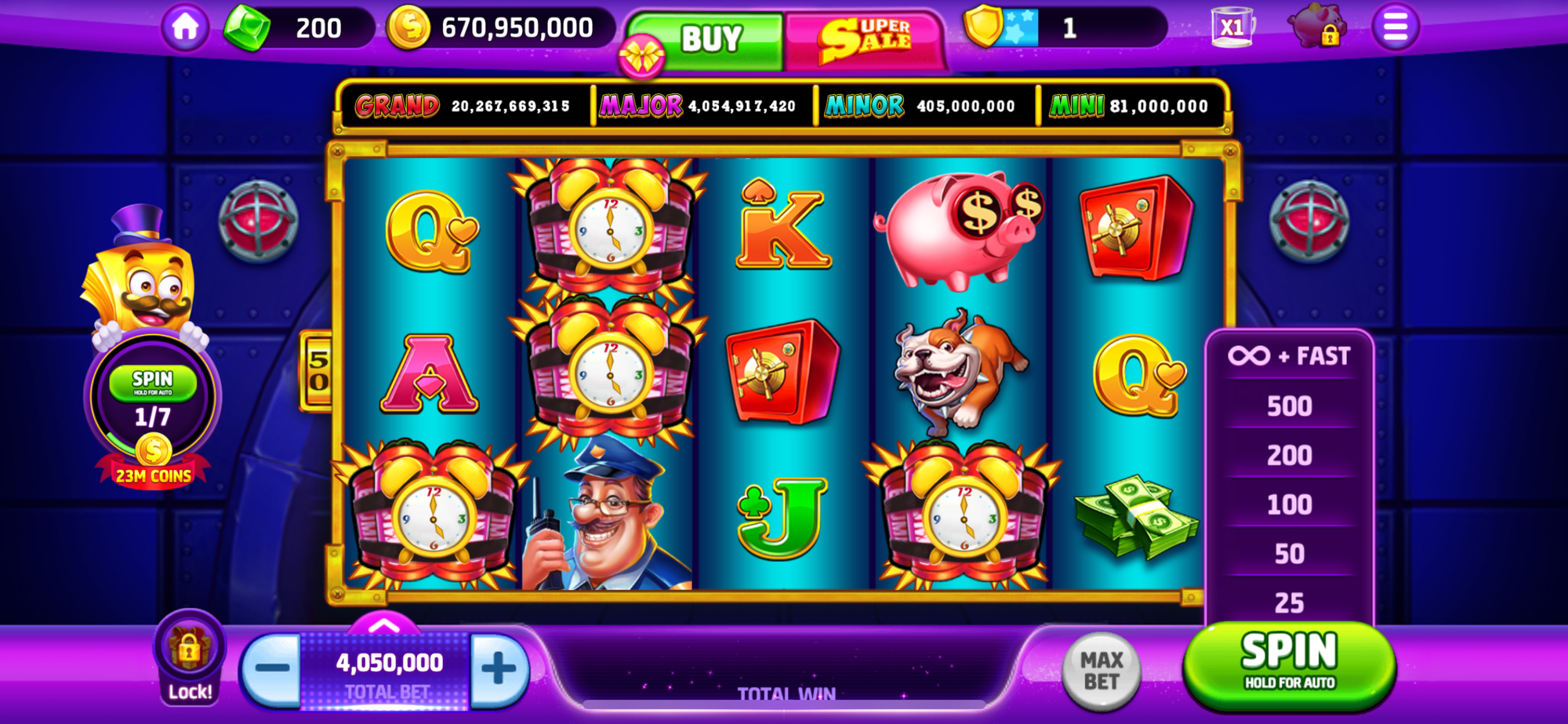

Cash Tornado Slots is a slot machine game. It’s made by AppLovin subsidiary Zeroo Gravity Games, so any revenues generated in the game go directly to AppLovin.

Cash Tornado Slots is an extremely simple game. There is no real strategy other than clicking a “Spin” button, just like with a real life slot machine. It’s entirely possible to simply click the same button over and over again to spin through the game and reach new levels.

Per the 10-Q for the quarter ending March 31, 2024, “In the three months ended March 31, 2024, three games, Wordscapes, Project Makeover, and Cash Tornado Slots, collectively represented approximately 13% of our revenue.”

Cash Tornado Slots has even more absurd incentives to pad APP revenue than even the previously mentioned games. I believe based on SEC filings that Cash Tornado Slots alone is responsible for roughly ~2-3% of APP revenue in 2024.

In 2024 via Swagbucks, users were incentivized to spend $49.99 on Cash Tornado Slots for a payout of 7500 SBs, or $75.00, effectively padding APP’s revenue in exchange for a $25 profit for consumers, paid out in around 10 days via PayPal or gift cards.

“Worked like a charm, showed pending [in Swagbucks] for $75 with the 49.99 purchase. Sweet. Thanks!” - Reddit user on November 2, 2024.

“Yeah, personally I just did the accumulated $49.99 purchase [on Cash Tornado Slots] and dipped.” - separate Reddit user in a separate thread on December 7, 2024.

Case 3: AppLovin Subsidiary Game Jackpot Friends

Jackpot Friends is another simple slot machine game, as of February 8, 2025 ranked #32 in the casino category on the Apple Store. It’s also made by AppLovin subsidiary Zeroo Gravity Games and appears to be a version of Cash Tornado Slots.

On Prodege site InboxDollars, consumers are currently offered the opportunity to use Jackpot Friends to effectively trade Apple Payments or credit card payments by making In-App Purchases for equivalent values in gift cards, plus extra incentives to reach various levels in the game.

The payment schedule/laundromat for transferring funds into gift cards is set out on the site and available as screenshots below.

-For buying the $4.99 package and contributing revenue to AppLovin, users get $5 via InboxDollars.

-For buying the $19.99 package and contributing revenue to AppLovin, users get $20 via InboxDollars.

-For buying the $49.99 package and contributing revenue to AppLovin, users get $50 via InboxDollars.

You can try this out right now, as of February 10, on Swagbucks or InboxDollars. Simply visit this link, agree to terms, authenticate with a Google or Apple account or input your email, and you will see this "gift card washing scheme" live, at least until it is taken down.

You can wash Apple Payments or credit cards and move money transnationally into gift cards today - just buy the 1:1 in-app purchases in Jackpot Friends, spin the slot machine as many times as possible, clear the levels, and you'll get Swagbucks to trade in for PayPal or gift cards on the other side.

Additionally, by reaching certain levels of the game, users effectively earn interest while they wait for their payment to pend.

Below is an example of Jackpot Friends core gameplay. Users simply choose an amount to wager, select the “Spin” button, and then can choose automatic spins, such as 200 or 500 simultaneous spins.

Case 4: Match Jong - “An easy $50 if you watch ads”

Here is an example of how APP is not only getting fatter revenue from their own APP subsidiary house brand games, but from partner games as well. This example is so absurd that consumers are simply being paid to sit and watch ads with little gameplay going on.

On November 24, 2024 a Reddit user posted on the r/swagbucks subreddit about how the game Match Jong was an easy $50 to watch ads in the game. This post is live here and archived here.

The user shared the below Swagbucks payment schedule for “watching ads” in Match Jong. By watching 10 videos, a user could earn 500 SBs or $5. By watching 30 ads, a user can earn 3,000 SBs or $30.

Match Jong is run by the studio Sophun Games Ltd., which names AppLovin as an ads partner specifically in their privacy policy. This privacy policy is archived here.

In fact, this Match Jong offer is so ridiculous and a direct subsidy for watching ads that it came up on Swagbucks forums many times during Q4 2024.

“Since many of the apps are just video watching ads, they should just come out with a straightforward ad delivery offer,” remarked one Reddit user on December 1, 2024.

“I'm making my way thru the Match Jong offer, which involves like 5% actually playing the game and 95% watching ads. It's fairly easy money but man do those scammy ads get tedious AF,” remarked a Reddit user on December 9, 2024.

“Same…and so many ads for bras, supplements, the pajamas with the dog faces,” replied another Reddit user, referencing AppLovin’s recent e-commerce push.

As of February 10, 2025 this offer is still active on Prodege sites, with users can "Earn up to $360.98 Cash Back" and are encouraged to watch reward ads in the game to speed up progress.

Do Consumers Even Get Paid Out After Playing APP Games/APP Partner Games? Or Are They Throwing Away Their Own Money and Time to Boost APP's Stock Price?

Prodege, the parent company behind Swagbucks, InboxDollars, and similar sites has one of the most egregious Better Business Bureau (BBB) accounts I’ve ever seen.

Nearly every single day for the past few months, and sometimes multiple times a day, BBB complaints are opened for Prodege not paying out users after they’ve already watched ads or paid money for IAPs on APP and APP partner games.

It goes on and on…

There are hundreds of BBB complaints over the last few months of consumers not being paid out, even after watching ads and/or making in-app purchases with their own money to feed APP and APP partner games and boost the stock price of APP.

Lessons from Zynga: It's Nearly Impossible to Compete With Your Own Acquisition Channels

Over a decade ago, Zynga, the maker of Farmville and other popular games in the late 2000s and early 2010s, failed spectacularly shortly after IPO.

While much of that narrative focuses on rise of mobile, what’s often missing from postmortems is the fact that Zynga was almost solely dependent on Facebook for acquisition. “Facebook” appears 204 times in Zynga’s S-1 and in Risk Factors states, “We generate substantially all of our revenue and players through the Facebook platform.”

Shortly thereafter, Facebook deprioritized gaming in their algorithm and ended their special relationship with Zynga.

APP is currently heavily dependent on Meta and Google and TikTok for user acquisition into its ecosystem for both APP house brand games and for the broader mobile gaming ads industry, where APP currently has a majority of ad mediation.

Here is an example of APP’s Project Makeover advertised on YouTube.

Here is another absurd example of an APP Project Makeover ad, featuring a woman poking a hold in a condom.

Here is another absurd example of this APP game, on TikTok.

Here is another absurd Project Makeover ad, on Meta’s Instagram.

Here is another Project Makeover game ad on Meta’s Instagram.

The problem here for APP is that they are now going directly after Meta/Google/TikTok ad dollars and presenting themselves as an alternative to prospective advertiser clients. If APP meaningfully gains share from any or all of these much larger players, these other players will simply deprioritize or cut off APP and mobile game ads in general on their platforms, just as Facebook did with Zynga a decade ago.

I believe this puts a low ceiling on future revenue growth of APP.

Conclusion

APP is more than priced to perfection, given that the two most popular games which account for 9-10% of revenue are engaged in a gift card/PayPal payout scheme, not to mention the fact that many other APP games and APP partner games also engage in this same scheme, driving ad impressions to extremely low-intent audiences through APP.

I do not believe that this activity creates users who are willing to spend money on large-ticket purchases from ads delivered through APP, given that these users are on the platform to make money and not to spend large amounts of money. We believe there are strong headwinds to the e-commerce narrative once APP’s initial pilots and test runs are over and that this momentum will not carry through 2025.

Additionally, one of the largest shareholders of APP, Chinese national Hao Tang, has recently sold out of a large part of his positions through multiple entities as of the January 30, 2025 dated Schedule 13G. For comparison, here is the previous Schedule 13G of Hao Tang’s entities, dated October 6, 2023.

The real money has already been made.

At this point by investing in APP you're investing in people in developing countries and extremely financially unstable people in the US who are playing mobile games and watching mobile game ads to make money, not spend money outside the mobile ecosystem, and you're investing in APP's weird obsession with fart- and fecal-related ads for their top games.

Please enjoy some of the many fart- and fecal-related ads from APP's cash cow game Project Makeover that appear on Meta, TikTok, and Google channels, plus enjoy some videos from all over the world explaining how to tap into Swagbucks and APP to watch ads for PayPal and gift card payouts.

Opinion: APP is a Strong Sell.

________

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Lauren Balik does not represent the interests of any fund or of any investor other than herself. Past performance is not indicative of future results. This content speaks only as of the date published. Any projections, estimates, forecasts, targets, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.