Doximity (NYSE: DOCS): Growth is Malignant, Not Benign

Opinion: Strong Sell. I am short DOCS. I believe DOCS is not "LinkedIn for Doctors" but "ZoomInfo Targeting Doctors" and it is a predatory business model set to burst in 2025.

Doximity AKA "LinkedIn for Doctors" is a business in declining health with major risks not accounted for by Wall Street.

As discussed many times in the healthcare professional (HCP) and investment communities, the primary end use case of Doximity among its user base of HCPs is not its social media platform but its dialer or phone number masking service, even as Doximity's revenue largely comes from pharmaceutical companies advertising on its platform in the platform's scrollable Newsfeed.

Doximity's accounting shows peculiar growth. I am diagnosing this growth not as a benign but as malignant.

In a market that has seen significant recent pullback among ad names like Reddit (RDDT), The Trade Deck (TTD), and AppLovin (APP) Doximity is highly exposed.

1) Doximity's revenue accounting and reported business metrics have become a joke. It's very obvious that Doximity is pulling forward revenue on large accounts as their longer-tail customers churn. That their auditor for many years Deloitte seems to be failing to execute on basic account standards shows how out of control this revenue accounting has become under CFO Anna Bryson.

2) Doximity operates one of the most absurd "pre-populated" social networks in existence, in which doctors and other HCPs are bullied into signing up for Doximity to manage their professional profiles else they may have incorrect information about them syndicated to US News & World Report and other sources of medical information and rankings. There is major risk in Doximity losing California HCPs and HCPs in other states with laws regulating processes requiring HCPs to upload IDs and collect data off HCPs as a requirement for these professionals to "claim" a pre-populated profile about them. This process has for years boosted Doximity engagement and usage metrics.

3) Doximity CEO Jeff Tangney was previously cofounder and CEO at Epocrates, which went public and endured the same practices of shifting revenue forward as the actual sales of the business failed.

Revenue Accounting Biopsy: Moving Large Customer Revenue Forward

Core to understanding Doximity's game is how egregious their revenue and business metrics reporting have become in recent quarters. Every action Doximity seems to have taken points to increasingly aggressive accounting that borrows from tomorrow to finance today. While this works for a time, when customer spend pulls back the house of cards typically falls.

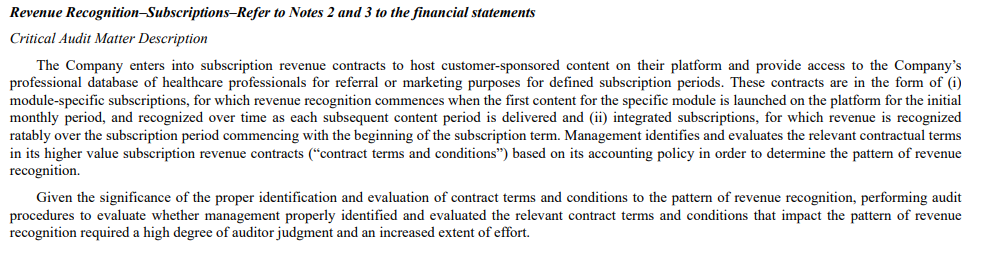

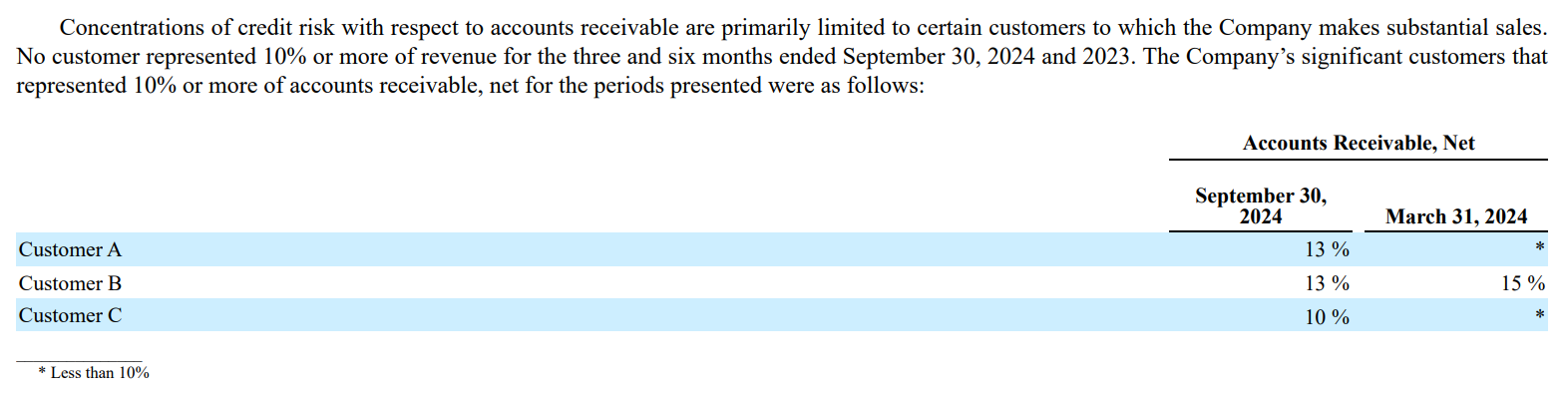

Of particular note is auditor Deloitte's comments on recent 10-K Critical Audit Matter regarding Revenue Recognition for Subscriptions.

This practice of sampling only higher value subscription revenue contracts while ignoring full customer base is out of line with the Public Company Accounting Oversight Board (PCAOB) Standard AS 2315: Audit Sampling Paragraph .39 which states:

Sample items should be selected in such a way that the sample can be expected to be representative of the population. Therefore, all items in the population should have an opportunity to be selected. Random-based selection of items represents one means of obtaining such samples. Ideally, the auditor should use a selection method that has the potential for selecting items from the entire period under audit. Paragraphs .44 through .46 of AS 2301, The Auditor's Responses to the Risks of Material Misstatement, describe the auditor's responsibilities for performing procedures between the interim date of testing and period end.

The lack of performance of this PCAOB Standard and basic mathematical standard by Deloitte during this audit unfairly weighs the largest contracts between Doximity and customers while excluding from the audit smaller and likely higher churn advertisers on the platform.

Additionally, this change in Critical Audit Matters on the last two 10-Ks appeared just as Doximity began to change around their two Key Business and Financial Metrics of:

1) Customers with at least $100k of revenue, TTM

2) Net revenue retention, or NRR

Doximity’s NRR as reported on their last 10-K has declined from 157% to 117% to 114% over the prior 3 years as this definition has changed to net smaller customer churn.

NRR on last 3 10-Ks:

The metric definition has changed three times over the last three 10-Ks but in the most recent state the changes do not seem to be retroactively applied to prior years. This metric comes with the disclaimer as of the most recent 10-K that:

“Subscription revenue excludes subscriptions for individuals and small practices and other non-recurring items.”

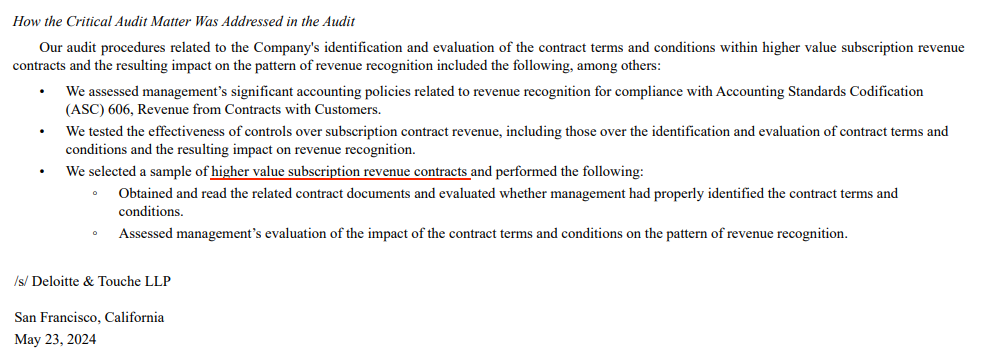

Showing further evidence of significant customer churn issues that have been masked over by only guiding investors to the largest customers is the “Customers Over $100K Revenue” metric, which in recent 10-Qs has changed to “Customers Over $500K Revenue” metric.

Doximity has aggressively retroactively moved this number as evidenced on the last several 10-K filings.

For example, for 10-K for FYE March 31, 2022 Doximity reported 265 customers with $100k+ of revenue for the prior year, but this number was dropped to 254 by the 10-K for FYE March 31, 2021 and again dropped to 251 for the 10-K for FYE March 31, 2024 during which time the $500K+ customer revenue metric was debuted on the 10-K. This retroactive change of customers reaching the $100K revenue threshold of 14 large customers or 5.6% (14/251) of the now-reported numbers for FYE March 31, 2022 suggests a pull forward. While many other companies may have 1, 2, 3, 4 complex contracts that require retroactive changes in subsequent, this is more significant at Doximity and changing around the number of customers

Further, the $100K+ customers represented 88% of revenue for FYE March 31, 2022, 87% of revenue for FYE March 31, 2023, 90% of revenue for FYE March 31, 2024.

Between the 10-Ks for FYE March 31, 2022 and FYE March 31, 2023 we also see this $100K+ customer number for FYE March 31, 2021 go from 200 when first reported to 188 the following year. This delta of 12/188 is 6.3% of these customers.

During the last few quarterly earnings, this Key Business and Financial Metric has shifted to $500K+ customers with $100K+ customers removed and not reported on.

While this may look like Doximity has signed large new deals in recent months going from 102 to 114 $500K+ customers, remember that this metric is Trailing 12-Month Subscription revenue and is backward-looking.

With auditor Deloitte only sampling the highest value contracts in the last two audits, with Doximity showing patterns of aggressive revenue recognition over the last two years, and with Doximity shifting both of their Key Business and Financial Metrics to better reflect only their largest customers, it is likely that significant churn has been masked over the past year and accounting has become more aggressive as deferred revenue runs out of steam - tomorrow has been borrowed from to pay for today but now it is yesterday’s tomorrow.

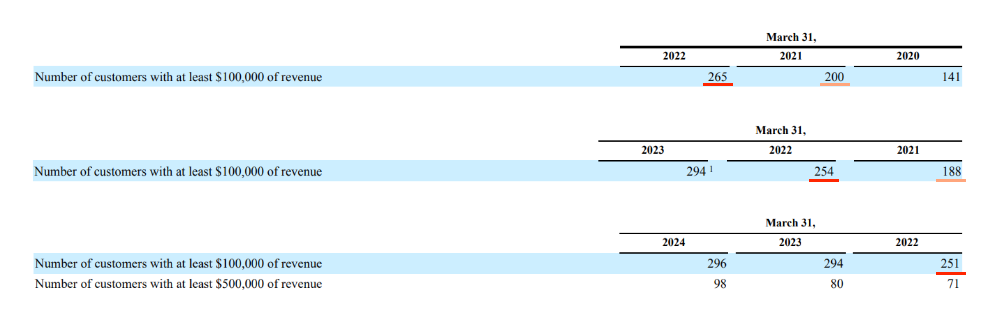

AR Concentration: Tipping the Cards in Hand

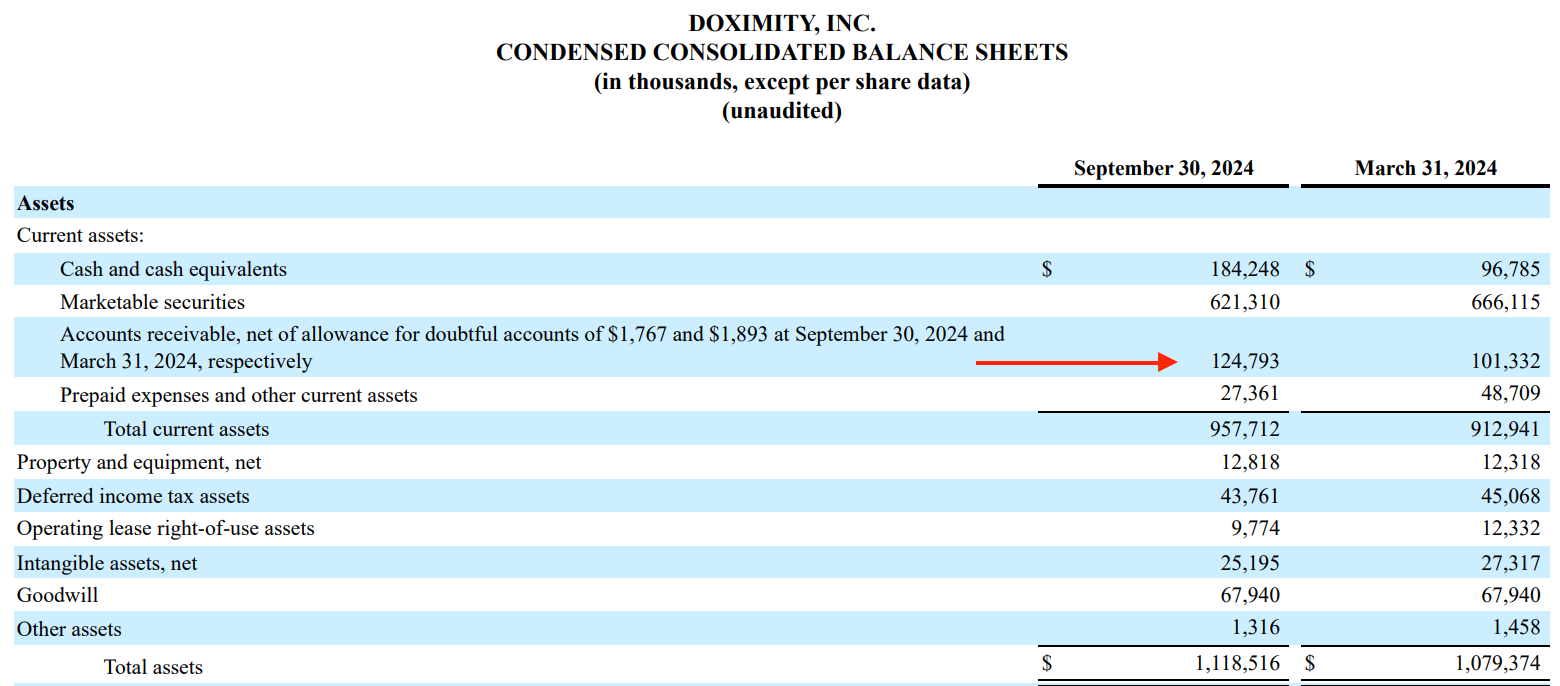

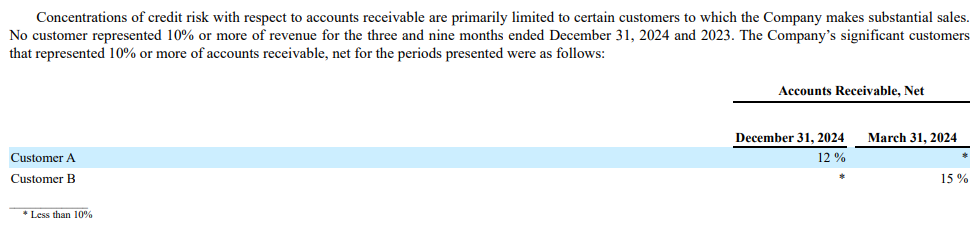

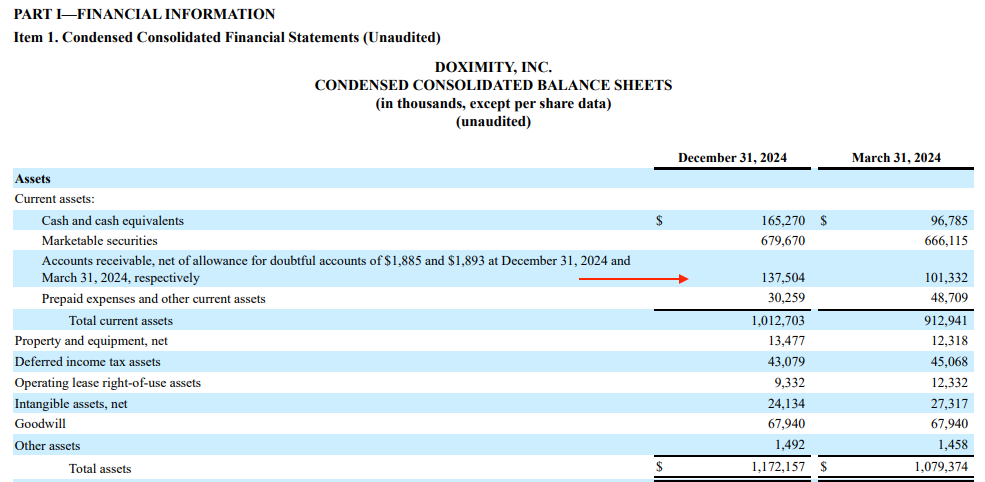

Although in all recent quarterly and annual reporting Doximity has claimed that no single customer accounts for over 10% of revenue in any recent period, one significant aspect that stands out is that on the 10-Q for quarter ending September 30, 2024 three customers represented in aggregate 36% of accounts receivable, net.

This 36% represents roughly $45M in AR concentrated among three customers.

While it would seem appropriate here to start calculating Days Sales Outstanding, I don't think that matters given significant the AR concentration. AR is already fairly high. I doubt there are major collection issues with this customer base of large pharmaceutical companies.

By the next 10-Q for period ending December 31, 2024 we can see that at least two of these customers were gone from the credit risk concentration even as AR increased.

This game of aggressive revenue recognition can only go on so long as the customers keep coming in, but as we've already seen Doximity is changing around their NRR definitions and moving their customers over X amount from $100K+ TTM to $500K+ TTM and their auditor is only sampling the largest contracts in the revenue recognition Critical Audit Matter and seems to be avoiding the smaller, higher churn risk customers.

Headwinds to DOCS

This space of marketing pharmaceutical offerings to HCPs has become significantly more competitive in the past year.

First, LinkedIn is now marketing aggressively to HCPs and has many more job opportunity listings for HCPs than Doximity.

Second, in 2024, Formedics was created through M&A as a social networking and content platform. This company owns the Physicians Weekly magazine commonly read among physicians among many other properties as well as Doximity direct competitor Figure 1, which produces content such as podcasts and serves as a higher quality version of the article sharing one may find on Doximity's content feed. With the acquisition of AMC Media, Formedics has positioned itself from the physical Physicians Weekly magazine and website to a full peer-to-peer platform.

Additionally, Medscape and Sermo remain two of the top platforms competing for pharmaceutical ad dollars.

With Robert F. Kennedy Jr. heading HHS and promising to ban pharmaceutical ads, there is a large abundance of caution throughout the pharma industry.

Doximity bulls may say that a national ban of pharma ads to end consumers is a tailwind for Doximity as this will create more incentives to market to HCPs directly through platforms aimed at doctors, which could include Doximity. However, on all conversations I've had with pharma marketers, the consensus is that there is a conservative attitude toward incremental spend on anything right now given the volatility that comes out of the Trump administration.

While RFK Jr. has promised to ban pharmaceutical ads to end viewers who are not necessarily HCPs themselves, Doximity has a large user base that is not necessarily HCPs but students who may be interested in taking nursing or medical school programs.

Doximity has a large number of students or potential students using its platform and these are people who are not necessarily yet HCPs themselves and thus unable to write prescriptions. This is not common among many ad platforms selling into pharma advertisers.

Aside from merely the volume of students or potential students, Doximity's offerings to these potential future HCPs has come under fire.

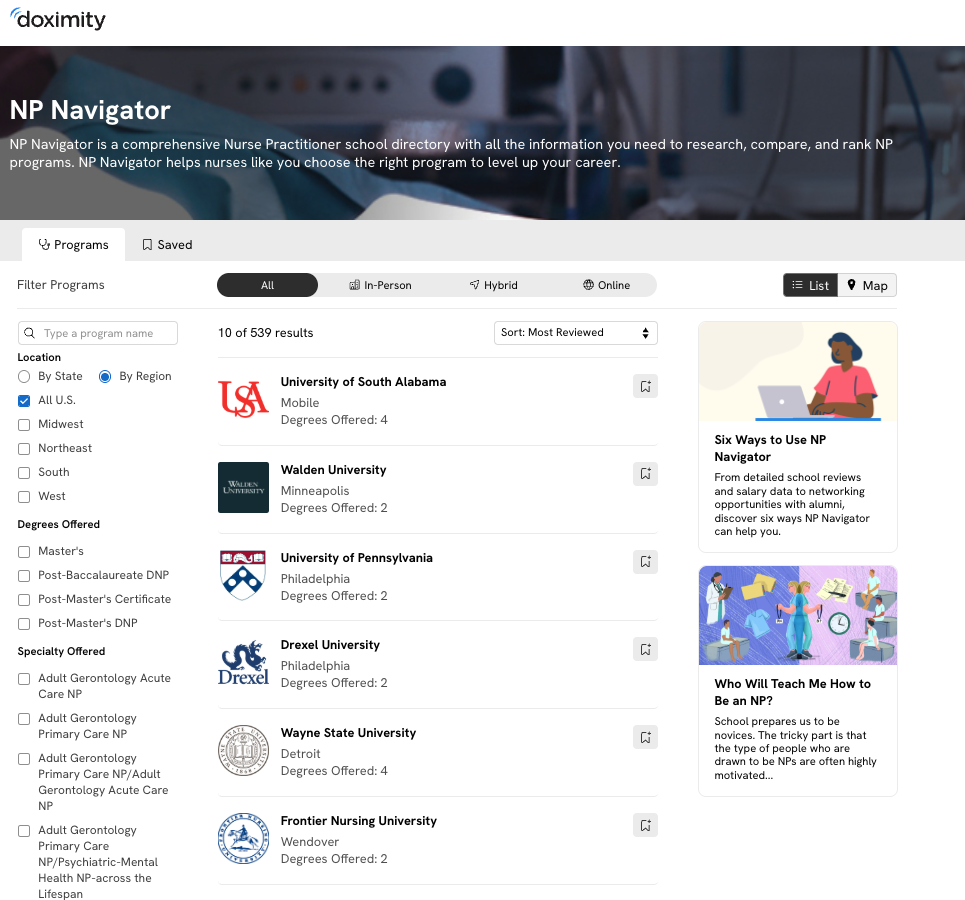

A study titled Program Misrepresentation in the Doximity Residency Navigator was published on August 15, 2023 and researchers found that an overwhelming number of accounts in Doximity's Residency Navigator contained significant missing information, with their sample showing ~42% of accounts in alumni and current resident profiles had no residency listed at all.

Digging deeper into the HCP user base, we can also see that Doximity's AI play branded as "Doximity GPT" has largely been a flop.

Per the most recent quarterly earnings call's prepared remarks, CEO Jeff Tangney claimed over 1 million unique active prescribers had scrolled Doximity's Newsfeed in the reporting quarter and 610,000 unique active prescribers had been active on Doximity's workflow tools in the quarter.

Tangney goes on to note in the call that Doximity's AI tools had over 1.8m prompts in the quarter and that this was a 60% improvement in prompts over the prior quarter.

At the back-of-the-envelope, if 610,000 users are doing over 1.8 million prompts in a quarter, that's a meager ~3 prompts per user over an entire quarter.

If even 10% of the base, so 61,000 users, made up the 1.8 million prompts, that's ~30 prompts over a full quarter.

As anyone who has used Chat GPT and similar products would know, Doximity is seeing especially low usage on their AI product even if the 60% Q-o-Q growth sounds good on relative terms. Using "number of prompts" is also a very poor metric here as well. As many know it can often take 2-3 prompts on a GPT or similar system for a user to correctly tailor and hone in on a proper answer for the question being asked. A much better metric would be the conversions of a final prompt's results being sent from an HCP to an end patient but of course this number would be much lower than 1.8 million.

The Pre-Populated Profiles Data Honeypot: Boosting Quarterly Active User Engagement

While most internet or digital businesses claim monthly active users (MAUs) or even daily active users (DAUs) as a top metric for advertisers or investors to evaluate platform usage, Doximity is mostly focused in their reporting on quarterly active users (QAUs?) for guiding investors.

Although extending metrics from monthly to quarterly is a tad more opaque and high-level this would be fine if not for a specific nuance to Doximity. Doximity actually has many pre-populated profiles for HCPs on the platform even if the person with the profile has never used the platform.

For example, if I were a pulmonologist Dr. Lauren Balik at Mount Sinai Hospital in New York City, Doximity may have a profile that says "Dr. Lauren Balik, New York City, Mount Sinai, Pulmonologist" pre-populated on it. This data used to populate Doximity would be on public records from Mount Sinai or may even be sourced from a LinkedIn profile I manage.

Now, if I had not made that Doximity profile myself and a colleague or coworker approached me on Doximity or had my patient or friend told me they had Googled me and my Doximity profile came up I would want to investigate about why this third-party website had my information on it. If someone is claiming to be me or to represent me online I would certainly wish to investigate to see what is occurring.

I strongly believe Doximity has been using these methods to "bait" doctors and other HCPs to "claim" their profiles in order to harvest ID data off doctors and HCPs, thus creating incremental engagement metrics for Doximity.

If your business is flat-to-declining, one great way to artificially create engagement metrics and usage on the platform is to strong arm doctors and HCPs into logging into your platform, scanning their personal IDs or driver's licenses, and forcing them to manage their profiles if Doximity is just going to be out here speaking for them anyway. If someone were speaking for you online on a closed platform wouldn't you want to investigate and log in and sign in to make sure you were being spoken for properly?

Through the 2010s, Doximity also signed deals to source doctor profiles for US News & World Report which operates a list of doctors and publishes lists of Best Hospitals, Best Medical Schools, and Best Health Insurance Plans. If doctors don't play ball with Doximity by signing up and engaging on the platform and filling out their profiles, they risk potential career harm.

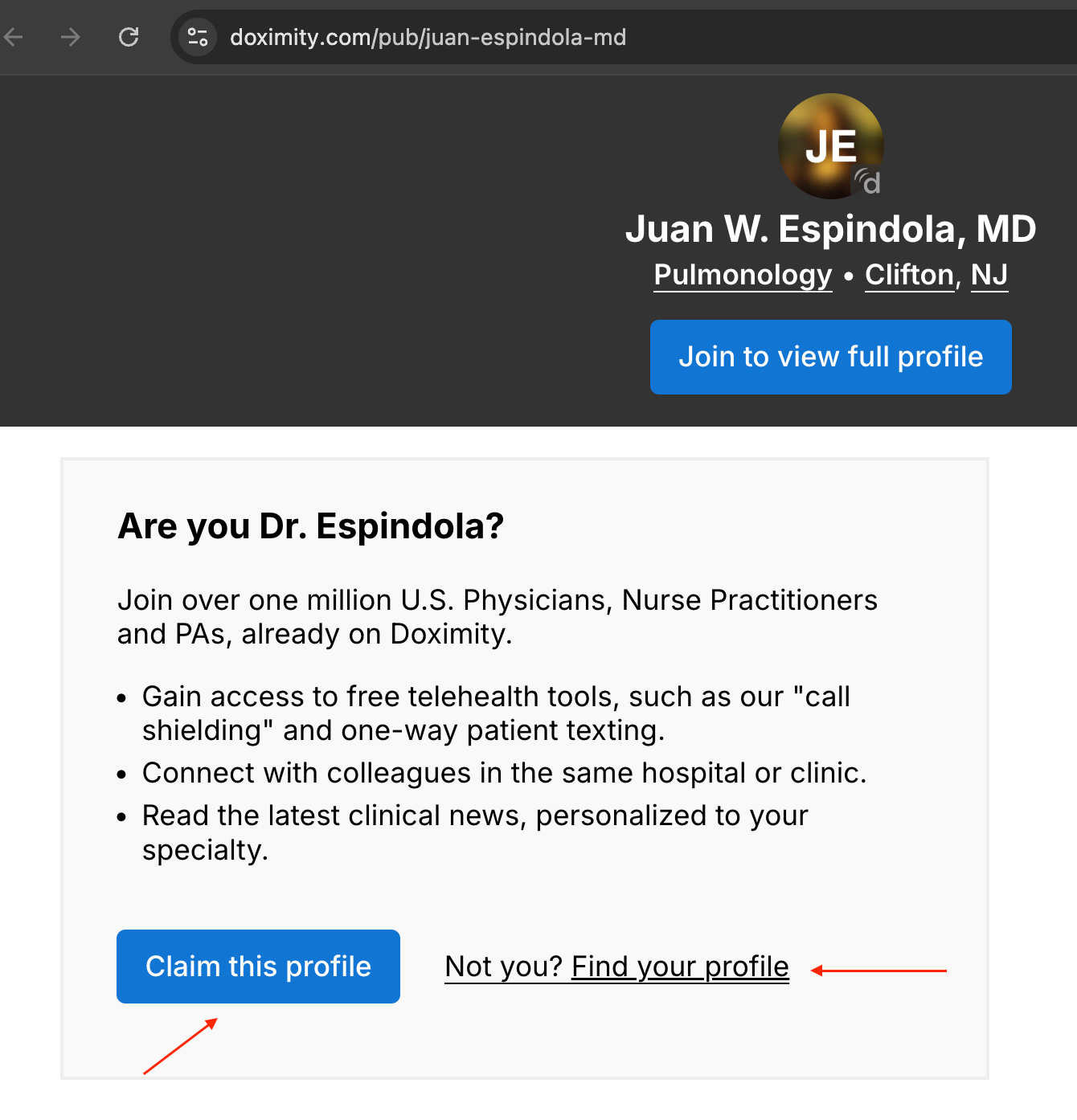

As an example, below we can see two examples of doctors who specialize in pulmonology in suburban New Jersey, just miles apart. These are two distinct experiences on the Doximity platform.

One doctor, Dr. Espindola, has an "unclaimed" profile that must be "claimed" on Doximity with information about him already partially pre-populated, even though Dr. Espindola appears on the Doximity platform and is searchable.

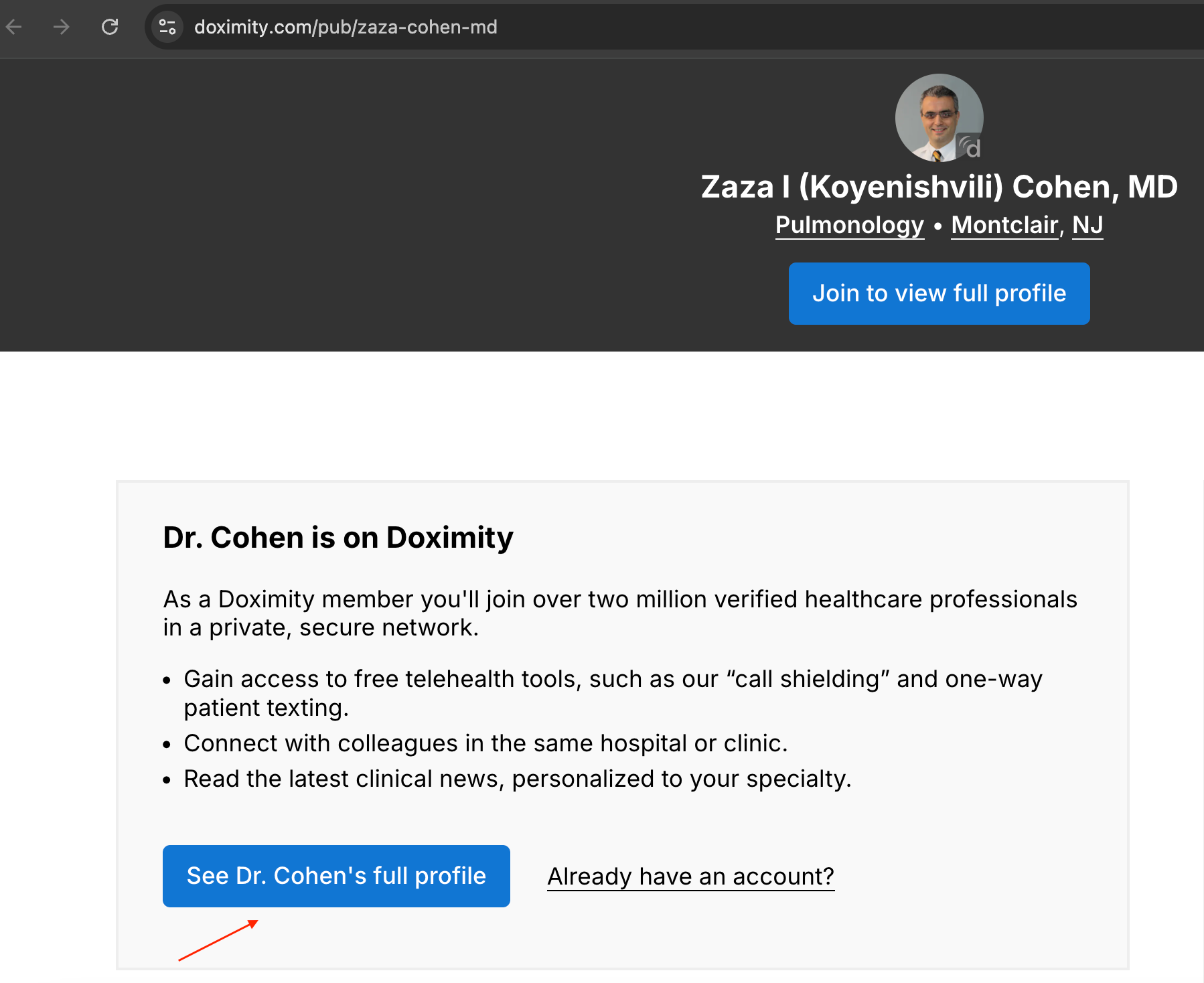

Second, we have Dr. Cohen, another pulmonology specialist in suburban New Jersey just a few miles down the road from Dr. Espindola. However, Dr. Cohen does not have an "unclaimed" profile and entering his profile from Google Search we can see he's got a different experience.

There are many thousands of doctors and HCPs throughout the US who have Doximity pre-populated profiles that remain unclaimed.

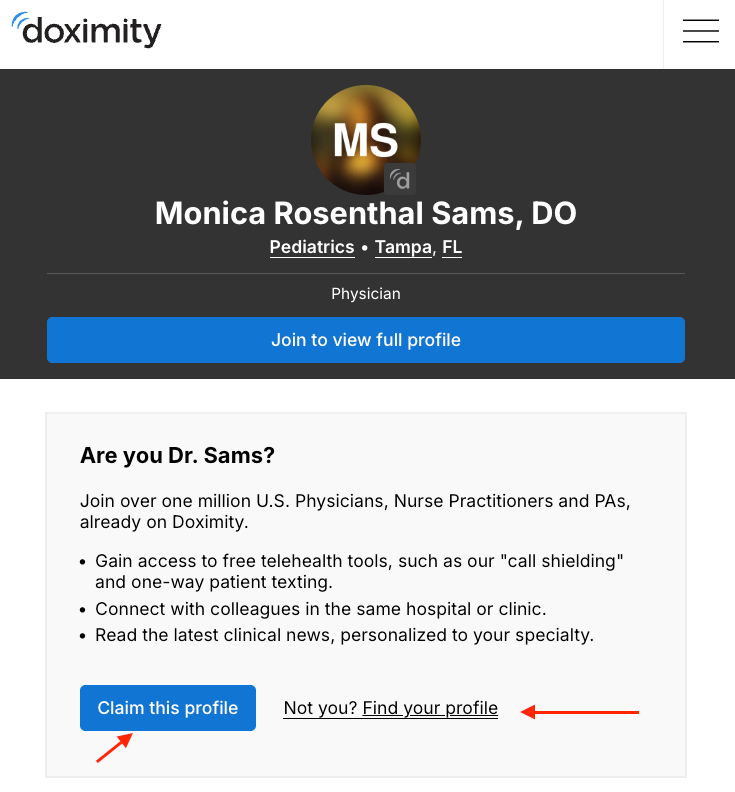

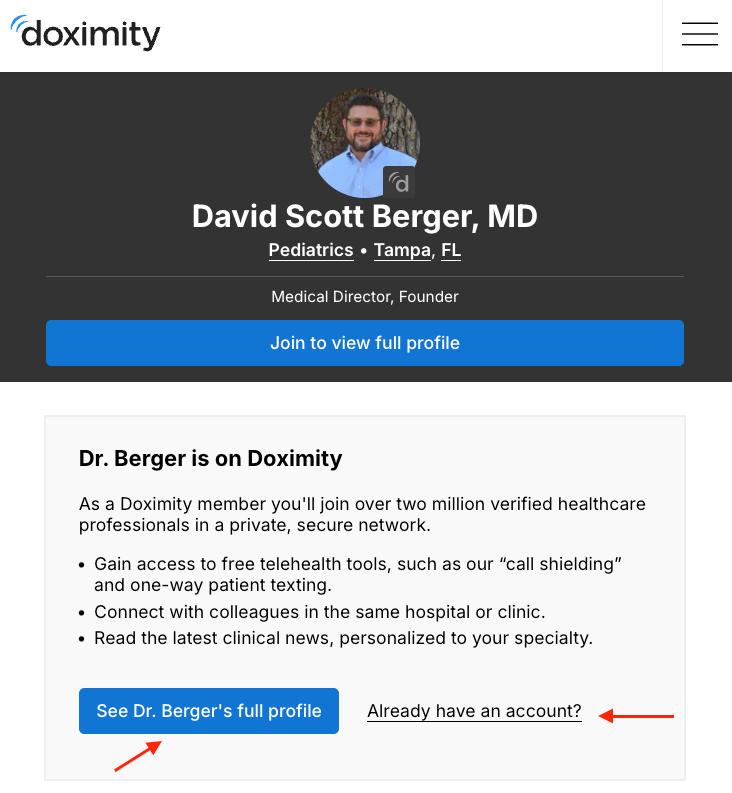

Two doctors in pediatrics in Tampa, Florida. One has not "claimed" a pre-populated profile and another seems to have claimed a profile on Doximity. This data is available through a simple web search.

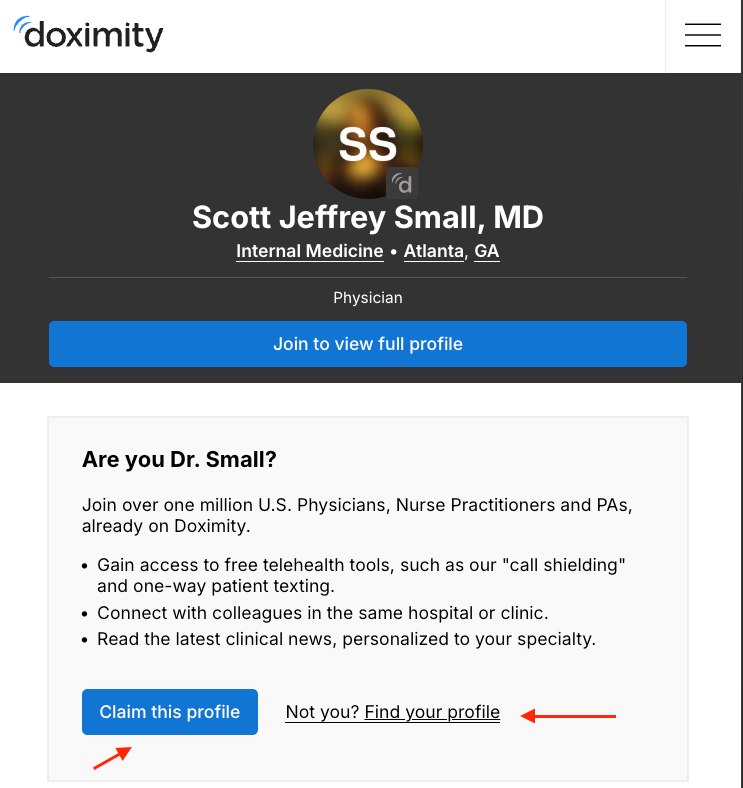

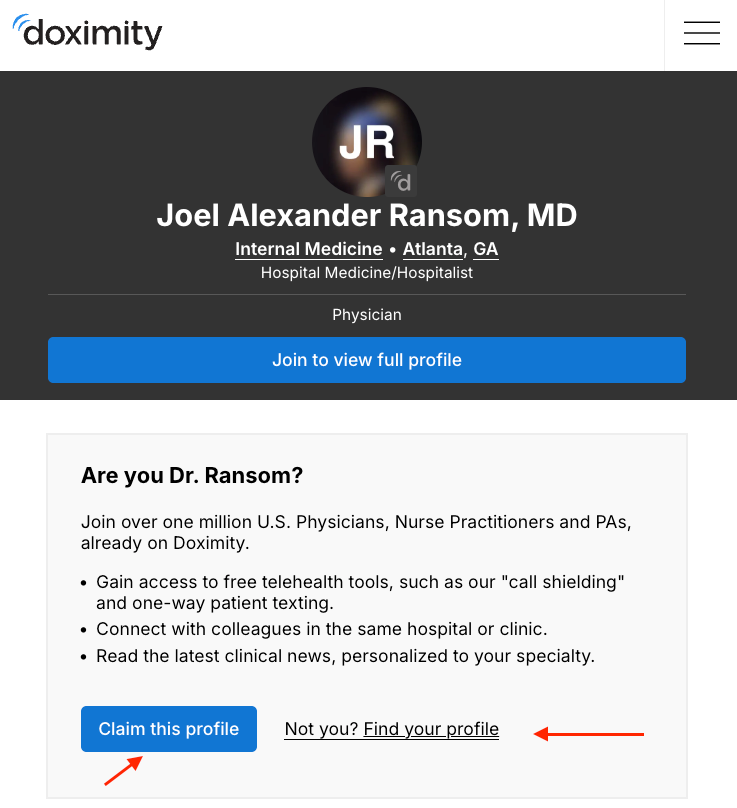

These two Internal Medicine doctors in the Atlanta, Georgia area have not claimed their profiles on Doximity, even though Doximity has pre-populated their profiles for them with low data validation.

Doximity is operating a data collection honeypot on doctors here.

Given that Doximity data is used to populate US News rankings through out the medical field, doctors, nurse practitioners, PAs, nurses, etc. are all personally and professionally incentivized to check out and sign up for Doximity in order to see what is being said about them or what information is presented about them or their employer.

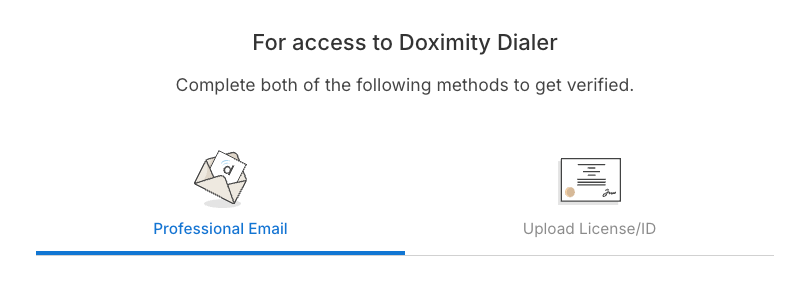

In order to claim a profile and "get verified" on the platform, doctors and other HCPs must scan personal IDs or driver's licenses into the platform and give this data over to Doximity.

Emory University published a guide for doctors to claim their Doximity profiles, stating:

"Most U.S. physicians already have a Doximity profile that’s been generated from public records. Doximity has a public-facing directory, which U.S. News & World Report uses in its online physician locator and to help determine its annual Best Hospitals rankings. Claiming and completing your Doximity profile is crucial to managing your online reputation, whether you actively participate on the site or not."

In fact, this behavior from Doximity is so egregious that even on Doximity's own website they claim:

"Doximity maintains a "stub" profile for clinicians based upon information in the NPI database. Therefore, joining our network typically begins with claiming a profile."

Of course this boosts engagement numbers on Doximity, which the company then reports as "growth" to Wall Street.

Every year thousands of new doctors, PAs, nurse practitioners, and nurses enter their respective fields. If a service like Doximity is pre-populating accounts and claims to represent you, of course you will be incentivized to go in and claim your account to ensure your information is accurate, especially if you are in a highly educated, highly professional field such as medicine.

Doximity CFO Anna Bryson Seems in Over Her Head

Doximity's CFO Anna Bryson has appeared in financial media many times, appearing to be just as confused as her listeners about finance. Given CEO Jeff Tangney's history at his former company Epocrates - which had its own significant revenue accounting issues - I believe Ms. Bryson is merely a mouthpiece for and a tool of Tangney.

Ms. Bryson had extremely limited FP&A or professional corporate finance experience before becoming CFO of Doximity. Her LinkedIn profile shows she was apparently a day trader of stocks before joining Doximity.

Additionally, leading up to Doximity's IPO and after, Ms. Bryson has appeared on questionable retail investor-oriented podcasts, including the below:

Why would the CFO of a company set to IPO go on a webcast oriented toward retail day traders?

Upon reviewing these retail investor-oriented interviews and seeing how large client accounts appear to have significant revenue moved forward, including accounts from 2021-2022 apparently dropping in revenue (as seen above in this report,) I do not believe Ms. Bryson possesses the financial prowess to effectively lead the finances of a $10B+ market cap company.

Conclusion

The data is crystal clear. Key business metrics are moving around with no explanation other than aggressively moving forward large account revenues. The auditor, Deloitte, is not behaving properly. Behaving properly would entail sampling a full body of customer account contracts and not just the largest accounts, in accordance with PCAOB standards.

Doximity now wishes to guide investors to only the behavior of their largest accounts, moving their reporting from $100K+ revenue customers to $500K+ revenue customers even as their NRR metrics collapse and change. Doximity has an abnormally high amount of AR to revenue in any given recent quarter, and as we can see this AR was recently concentrated among only 3 customers. It's likely that a large percent of current period revenue is just Doximity rolling forward revenues and discounting AR from their top contracts, which are so large they mask the degradation of sales present in the rest of the business, at least until it all falls apart.

I fundamentally believe that smaller customers have already dropped off the platform and more will drop off given the current political environment.

What DOCS has going for it is that many pharmaceutical contracts are re-upped in September/October of a given year and that this occurred before the last US presidential election. The spend environment in pharma has become very conservative as of late, as ad dollars are at risk given that nobody has any idea what Trump/RFK Jr. may announce on a given day regarding regulation or new policies.

With such apparent aggressive revenue accounting combined with a turn away from spend in pharma and with Doximity running a years-long shakedown on doctors and HCPs to make them sign up for their platform as Doximity has pre-populated profiles through sketchy data collection, I believe this is a fantastic short both now and through the 2025 calendar year. It is all about to come to a head.

I believe Doximity (DOCS) is a Strong Sell and a short in the backdrop of advertising names facing significant pressure.

Is Doximity actually LinkedIn for Doctors?

Or is Doximity merely ZoomInfo Targeting Doctors?

________

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Lauren Balik does not represent the interests of any fund or of any investor other than herself. Past performance is not indicative of future results. This content speaks only as of the date published. Any projections, estimates, forecasts, targets, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.