AppLovin's E-Commerce Story is Nothing But a Pyramid Scheme

Free money for scrolling through hundreds of ads, free money for recruiting new members, high coupon sales for AppLovin going headstrong into an e-commerce narrative: Let's dive into AppLovin's related party e-commerce pyramid scheme Flip, which is driving AppLovin's DTC e-commerce growth as Wall Street remains asleep at the wheel.

Free money for scrolling through ads on Flip. Earn by posting & scrolling on Flip. 1. https://www.facebook.com/story.php?story_fbid=1614189643315741&id=100063639637560 2. https://www.instagram.com/p/DE1pTpbAevb/

Get Paid to Scroll (through ads delivered in Flip, via AppLovin's AXON "AI" technology.) "Is this real?!"

@mamatiefling Ok so has anyone had a ton of success with Flip? I’m not sure it’s for me to be honest. #flip #ugccreator #ugccontentcreator #ugc

♬ original sound - Laura || 🍄Mama Tiefling🍄

Get Paid Just for Watching Ads!

Key Points

- AppLovin's "e-commerce" narrative is clearly largely driven by related party app Flip, which as of early 2024 utilizes AppLovin's AXON technology in the Flip platform to serve and prioritize user-generated ads.

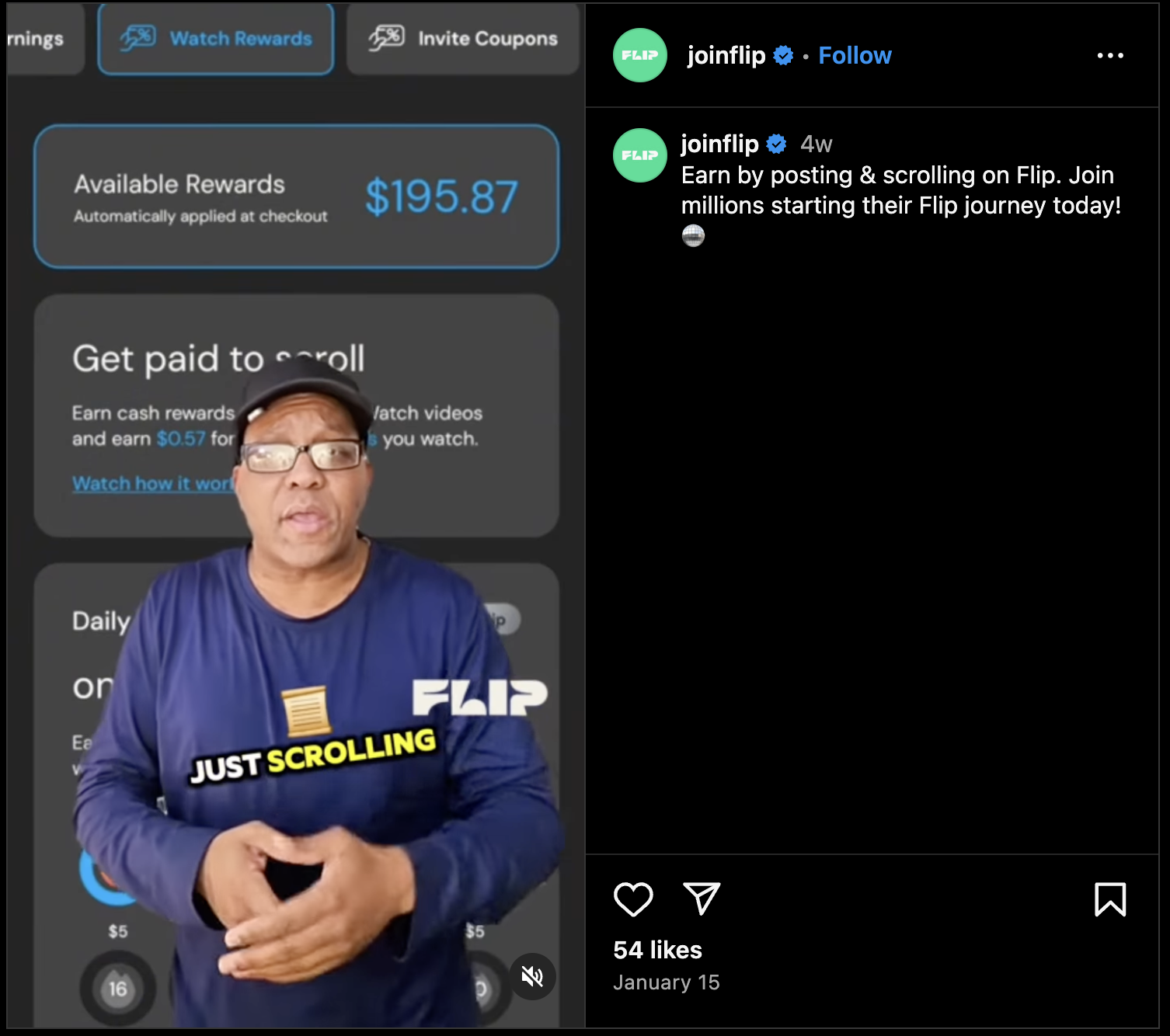

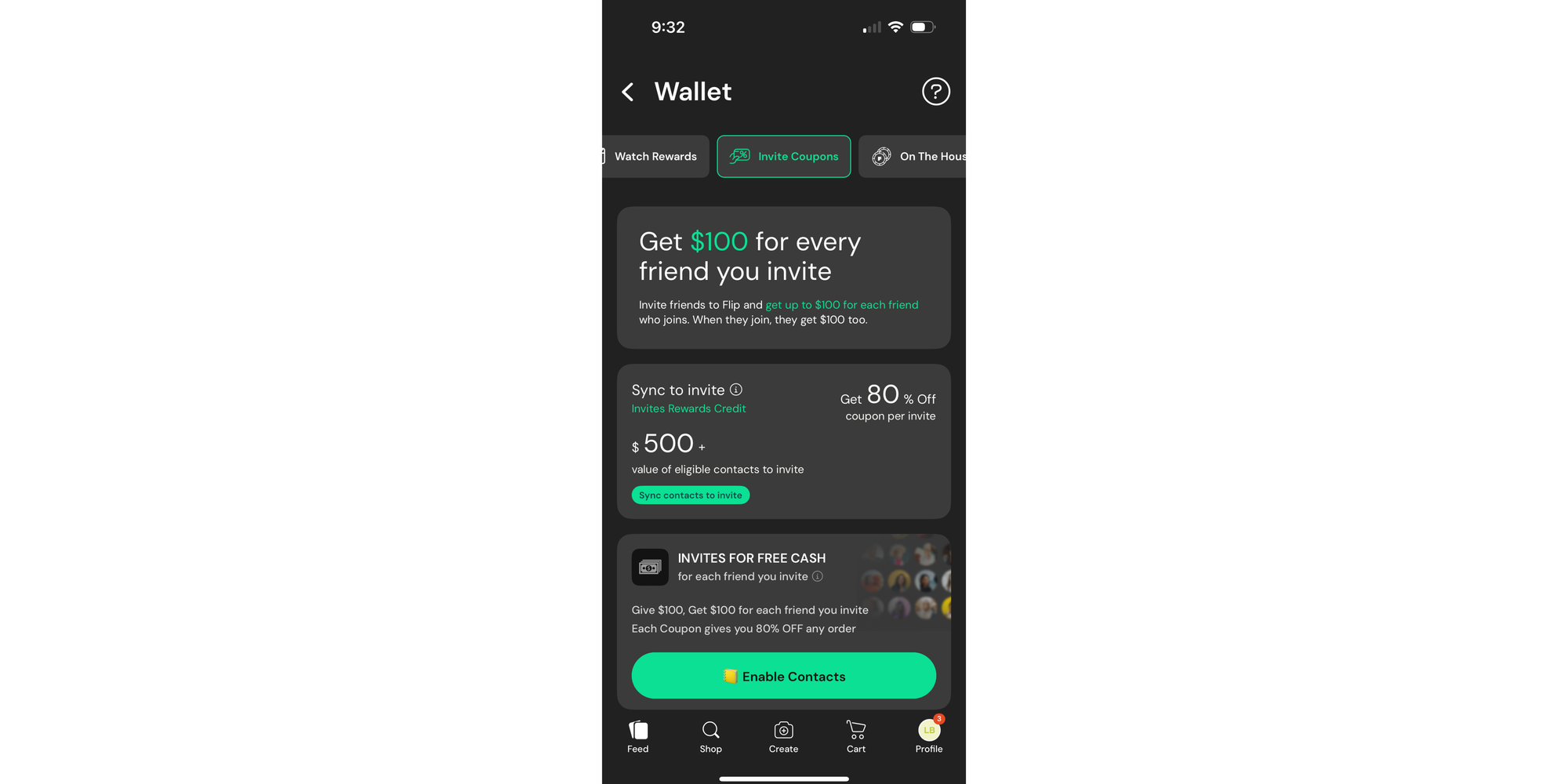

- Flip users are quite literally incentivized to scroll through as many AppLovin AXON-powered ads in the Flip platform as quickly as possible to accumulate in-platform coupon cash, which can then be added for discounts on sales within Flip. However, users must still spend their own money on each purchase as none of the discounts from scrolling fully contribute 100% of a purchase. This accomplishes very little outside of raiding Flip's cash balances in order to put revenue on the board for AppLovin.

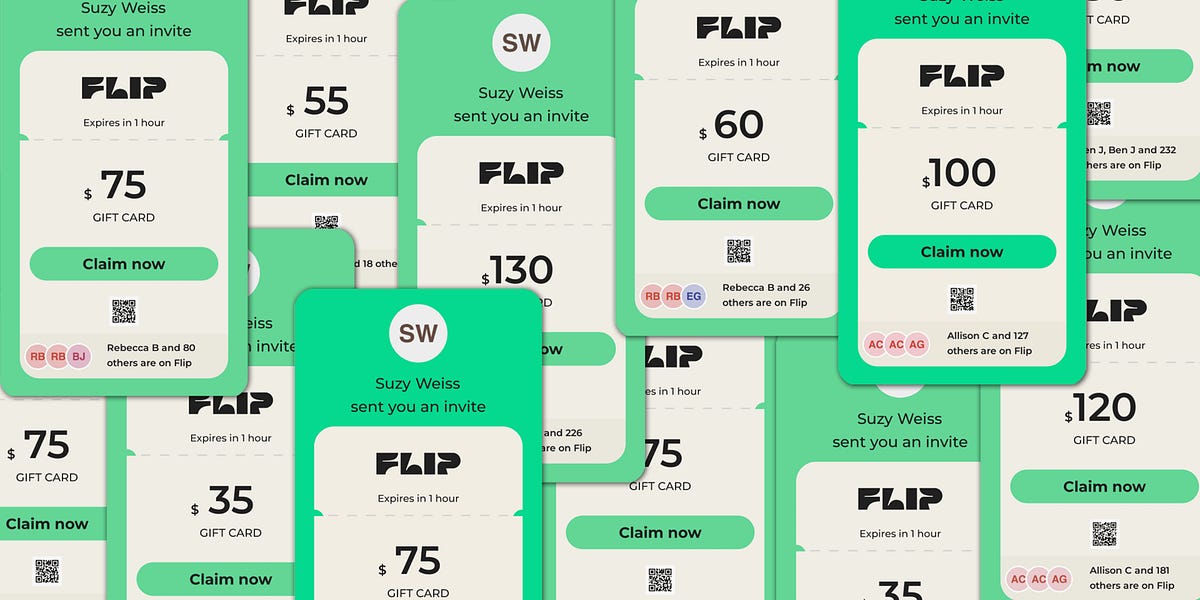

- Flip's business model has been described in media as "a Ponzi scheme" per The Free Press and as a business with "fuzzy economics" per The Los Angeles Times, given that Flip users make more money from referrals by uploading phone contacts for discount coupons vs. actually selling products as influencers on the Flip platform.

- Flip users are required to buy products through Flip for an entry fee prior to posting content on the platform, thus clearing sales for e-commerce brands through ads delivered in-platform via AppLovin's AXON.

- This requirement to purchase products from Flip effectively gives AppLovin sales credit via a revenue share agreement between Flip and AppLovin, even though AppLovin does essentially nothing. Wannabe influencers join Flip and quickly scroll through ads to generate coupons to use for discounts to buy a few cheap, initial products to review in order to potentially make money posting product reviews on Flip. This is not because of anything AppLovin's AXON "AI" technology is doing, rather it is because Flip's pyramid scheme business model requires consumers to make initial purchases before these wannabe influencers can monetize on Flip by making their own product reviews.

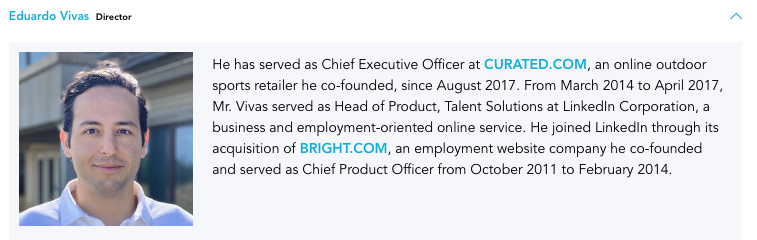

- Longtime AppLovin Board member Eduardo Vivas (who is also the brother of AppLovin executive Rafael Vivas) sold his company Curated to Flip for $330M in Flip stock, coinciding with Flip's Series C capital raise that valued Flip at ~$1.1B, which included a $50M cash investment from AppLovin and a revenue share agreement between Flip and AppLovin while Eduardo Vivas was on AppLovin's Board. Eduardo Vivas effectively picked the pocket of AppLovin's balance sheet to pay himself, he turned his Curated ownership into Flip stock, and then he set up a revenue sharing agreement where AppLovin gets credit for Flip sales which, due to the requirement in Flip that users pay first and clear sales before posting, generates sales attributed to AppLovin as extremely high margin, pure revenue.

- Flip has recently announced a $100M "Creator Equity Fund" in January 2025, as announced through Flip and in TechCrunch, with Eduardo Vivas claiming, “We don’t currently see an acquisition as an interesting outcome for our company. Our goal is to take the company public one day.” However, these influencers may soon find themselves sitting on valueless equity. After all, how long can a platform continue giving away "free money" just for sharing phone contacts and for mindlessly scrolling through and clearing ads? Aren't all of these influencers competing with one another to be one of the top few video product reviews for each SKU? I believe Flip's capital structure is designed by nature to collapse, as I believe Flip's sole purpose of existing at this point is to share easy pyramid scheme revenue to publicly-traded AppLovin and boost AppLovin's stock price.

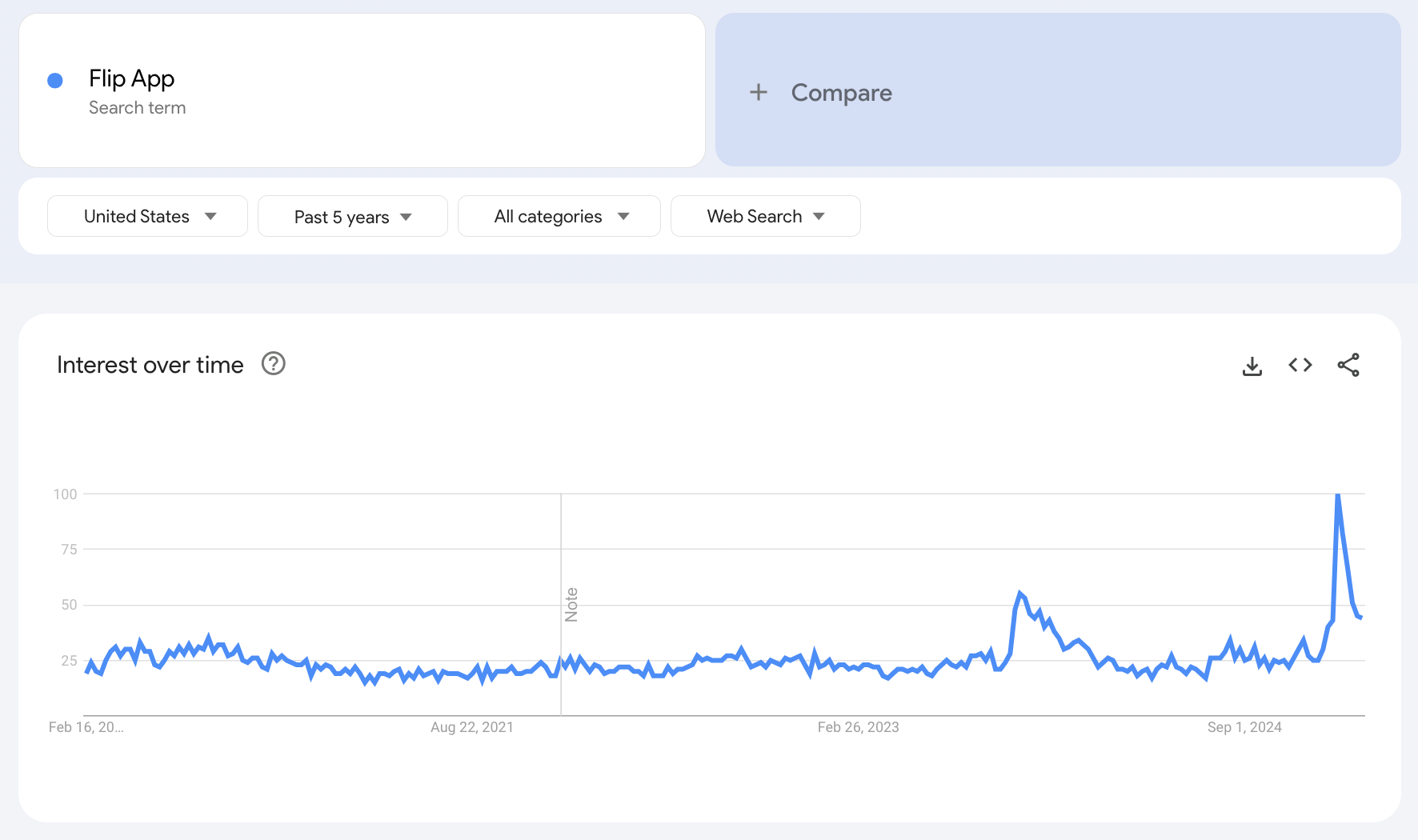

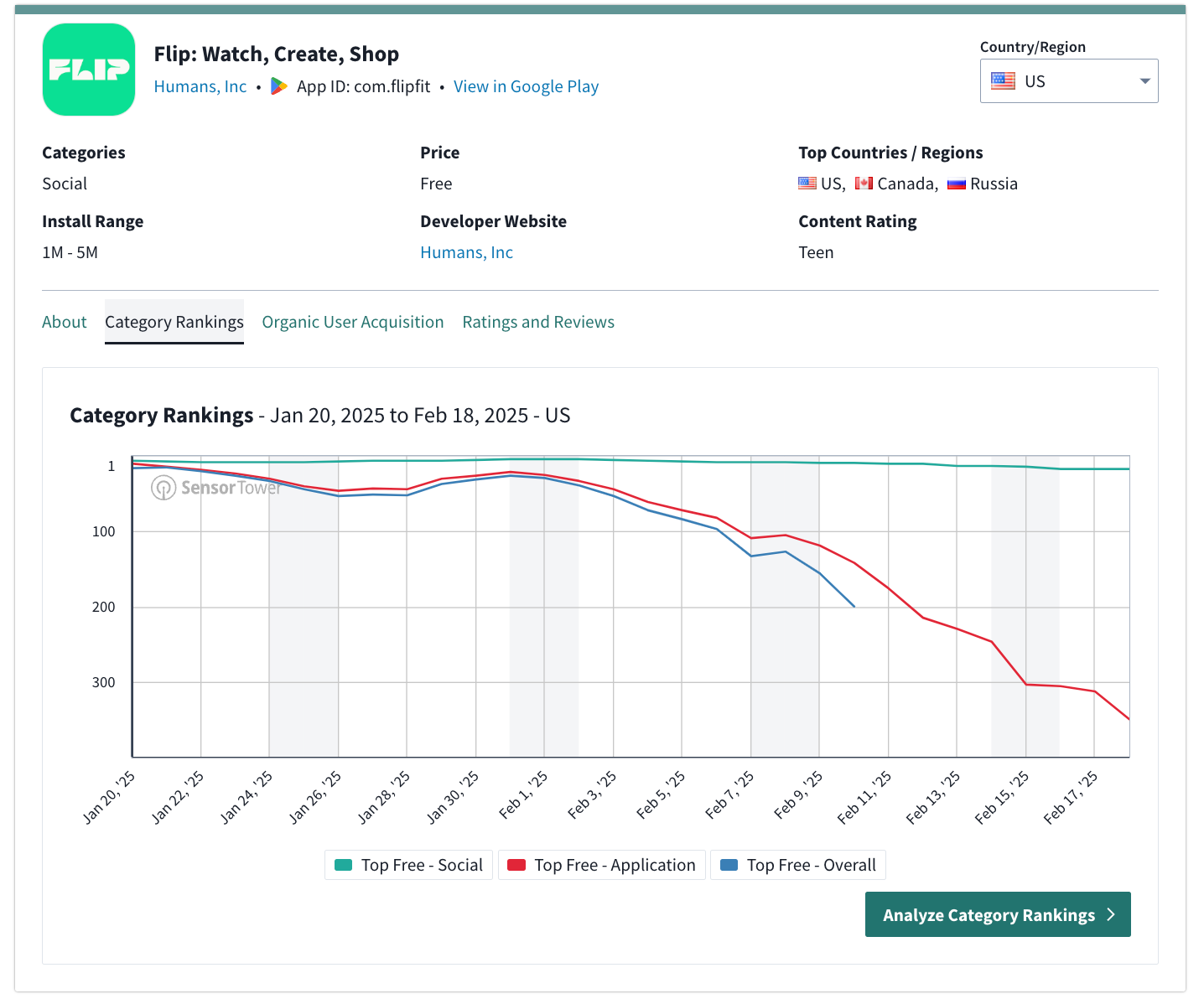

- Flip has recently appeared among the top downloaded apps in both the Apple Store and Google Play Store, among the Top 10 overall free apps on both platforms. This is largely due to the Biden-Trump transition related to the TikTok temporary ban. A recent Modern Retail trade publication piece featuring AppLovin Board member/Flip President Eduardo Vivas claimed ~250,000 Flip user signups per day in January 2025, which would put Flip at roughly 7.75M new signups in that month (although this number seems extremely aggressive and does not align with any other public industry data). However, Flip completely botched this event with the app... crashing for most... new users.

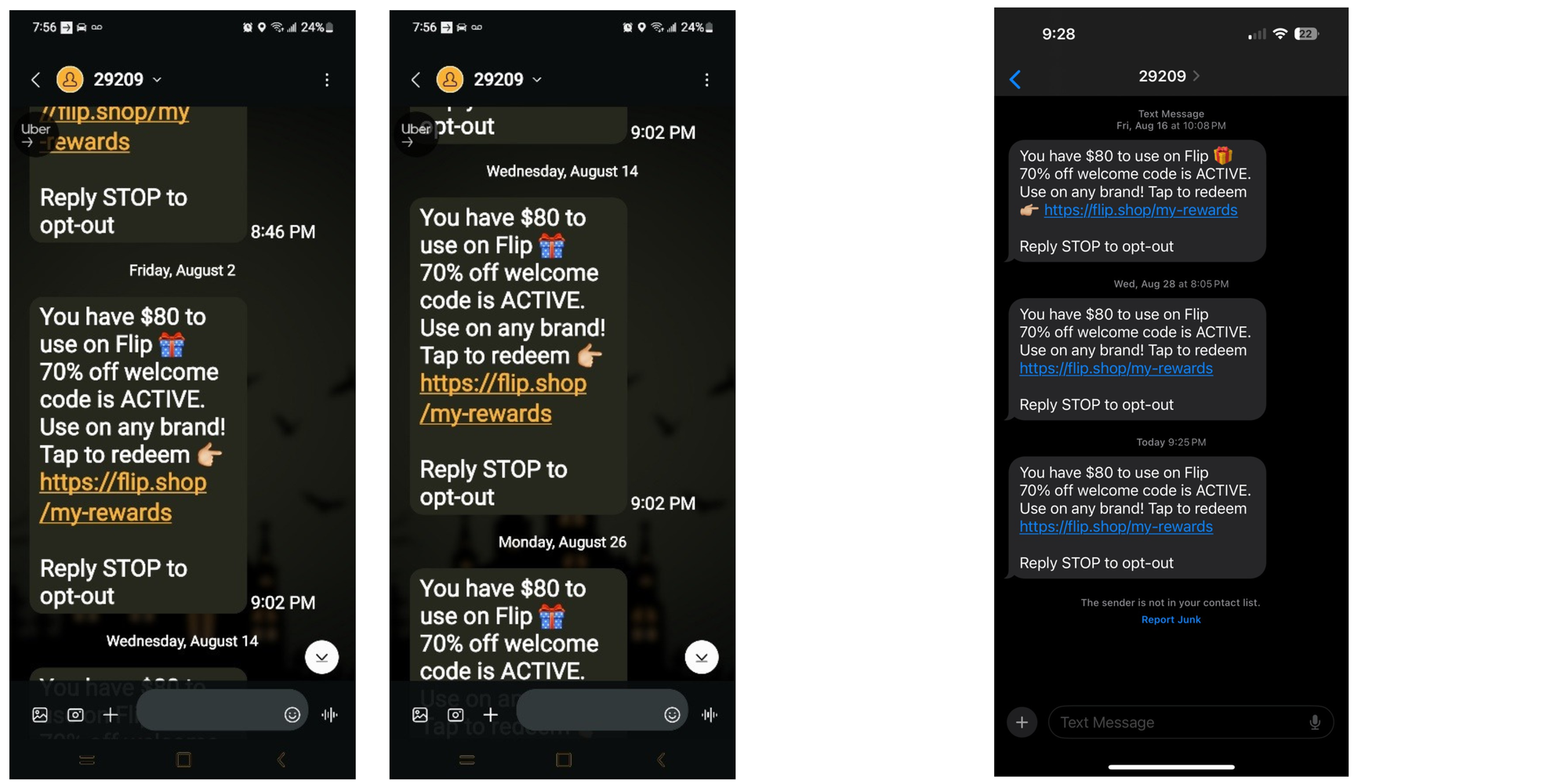

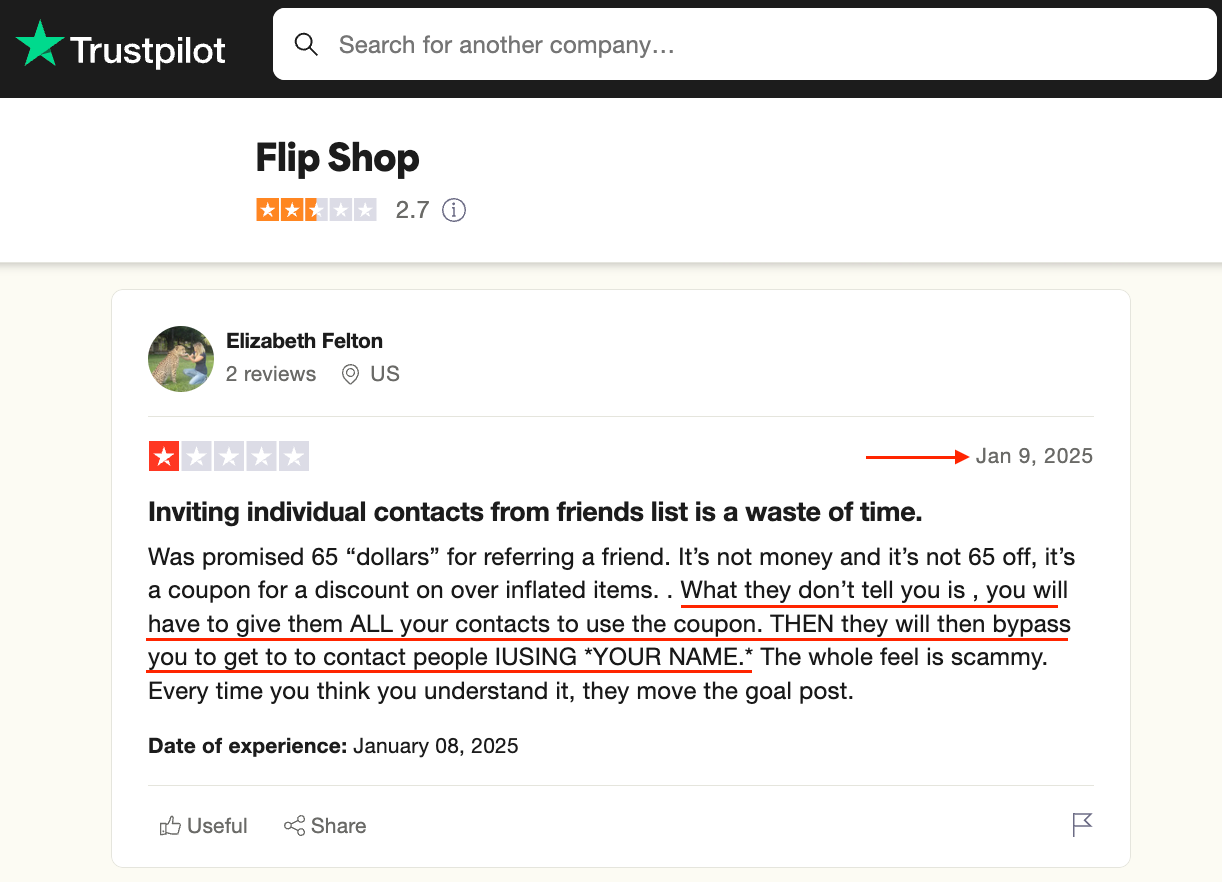

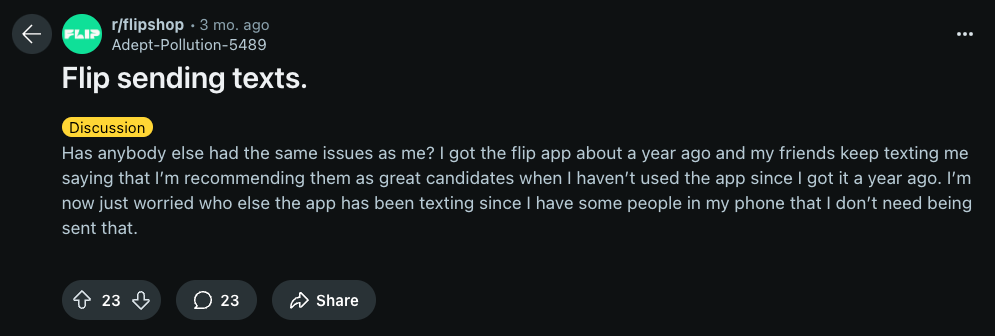

- Flip's practices of harvesting user data for AppLovin are abhorrent. The practice of uploading all of a user's phone contacts into Flip to then have all contacts spam SMS'd has already been challenged several times, with multiple parties suing Flip for unwanted text messages. Users have also taken note, posting on social forums that people they hadn't spoken to in years were being contacted by Flip with offers - a classic pyramid scheme tactic of recruiting people from the fringes of social networks into the scam, not at all unlike random people from middle school reaching out as an adult to sell you makeup or leggings.

- All pyramid schemes eventually collapse. It is a classic investing mistake to believe that waiting for the cops or regulators to show up is a good idea when shorting pyramid schemes. History shows that most pyramid schemes collapse on their own once the TAM of suckers becomes exhausted and enough people lose their money. I believe based on industry data and internet signals that the AppLovin/Flip pyramid scheme is already heavily on the decline and has already served its purpose of putting revenue on the board for AppLovin, and now it's got nowhere to go but down from here.

- Further, these ridiculous games of circulating revenue to prop up an "e-commerce growth" narrative are no different than AppLovin's engagement with gift card payoffs, where users anywhere in the world are able to throw money into AppLovin mobile games and AppLovin partner games and get a return back for buying in-app purchases or for scrolling through AppLovin-delivered ads, which I covered in great detail last week. How long can a business like AppLovin last when $75 gift card payouts are offered for $50 in revenue boosts?

On February 12, 2025 AppLovin hosted their quarterly and financial year-end earnings call, officially moving the company to one focused on e-commerce clientele and announcing that AppLovin had received a term sheet to sell its mobile gaming business.

AppLovin CEO Arash Adam Foroughi did not answer questions on the call about how much revenue (nor EBITDA, nor any inputs or outputs) broke down into this new category of e-commerce, yet Wall Street has run away with this e-commerce story.

The video call is available here via AppLovin's IR site, or at your favorite third-party transcription service, or on YouTube.

At 2:11 in the intro, Foroughi makes it clear he will not break down e-commerce growth.

At 11:06 in the analyst Q&A, Foroughi can't explain in any detail how this model scales in e-commerce outside of DTC.

At 15:00 we see more AI gobbledygook about model training growth that means absolutely nothing.

At 19:06 after being asked by an analyst to share details about the e-commerce "pilot" Foroughi again will not go into details and again defaults into Adjusted EBITDA/employee.

... and so on.

I'll give you the spoiler alert. There are no details about e-commerce because AppLovin has very few real e-commerce use cases and what's actually driving e-commerce is the Flip pyramid scheme.

The Flip Pyramid Scheme: Every Classic Pyramid Scheme Sign is in Place

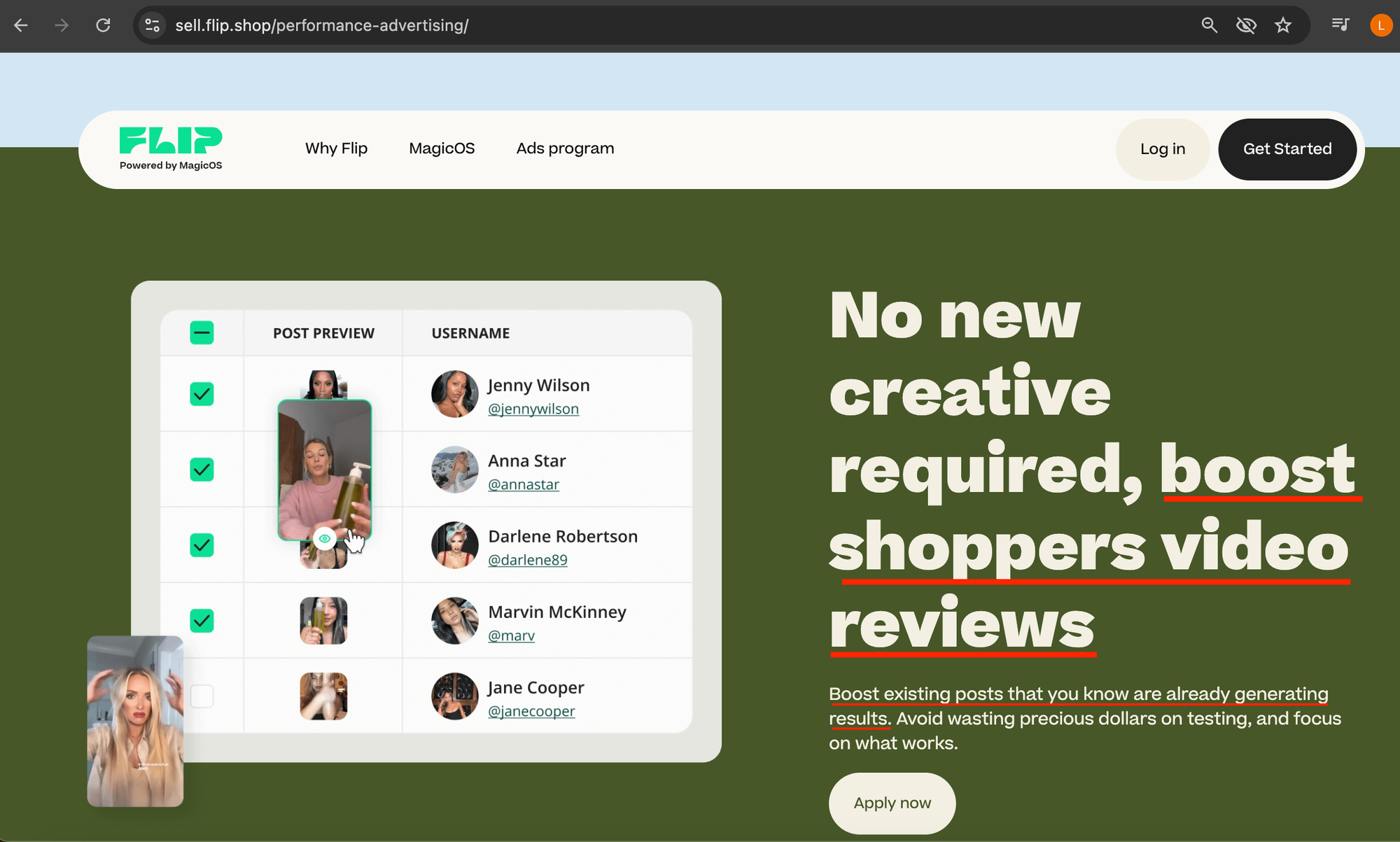

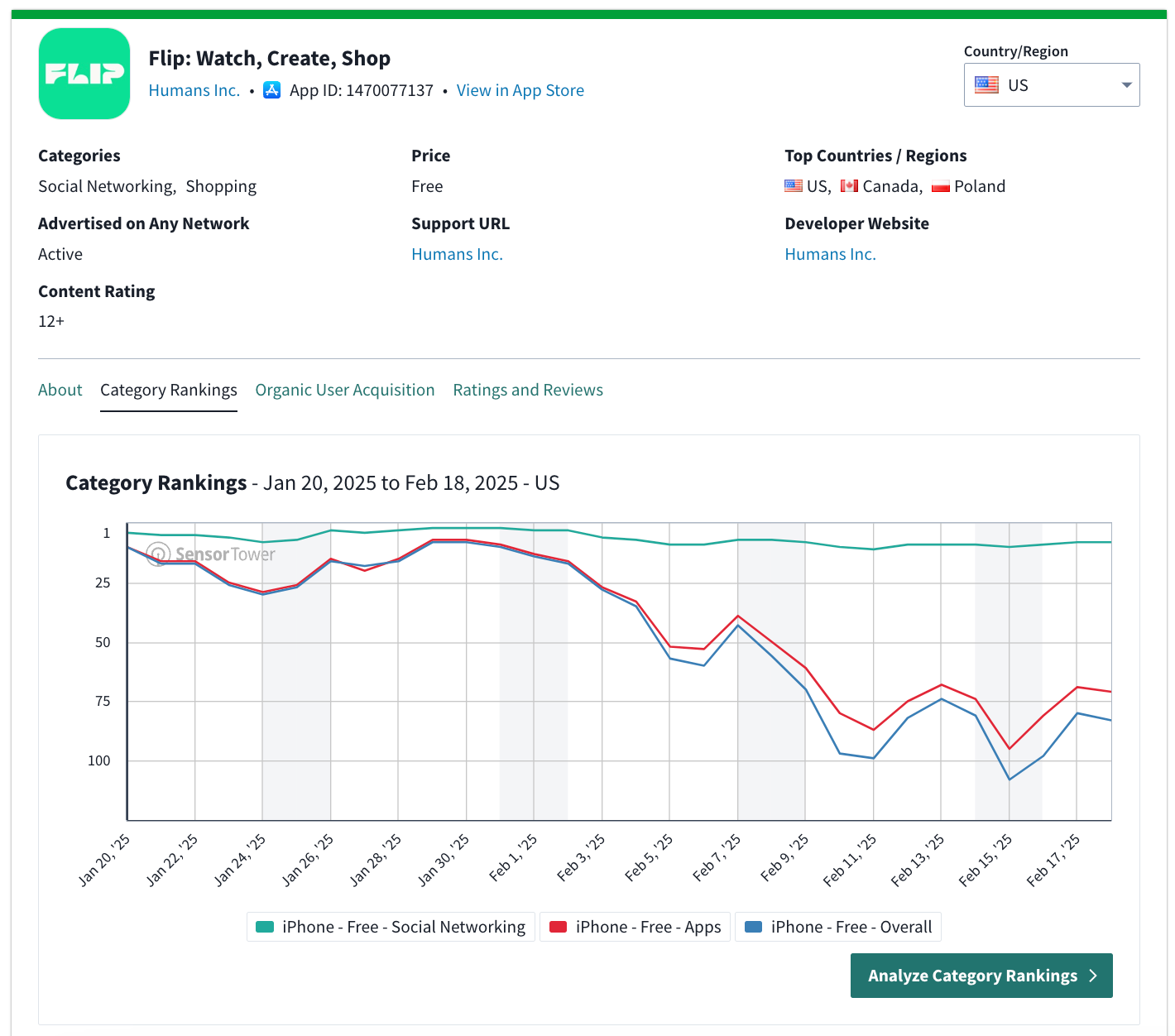

Flip is the product of Humans, Inc. As of February 16, 2025, Flip is the #9 free social networking app in the US Apple Store and has been hovering in the Top 10 for Social Networking in Google Play and App Store from Q4 2024 through January 2025.

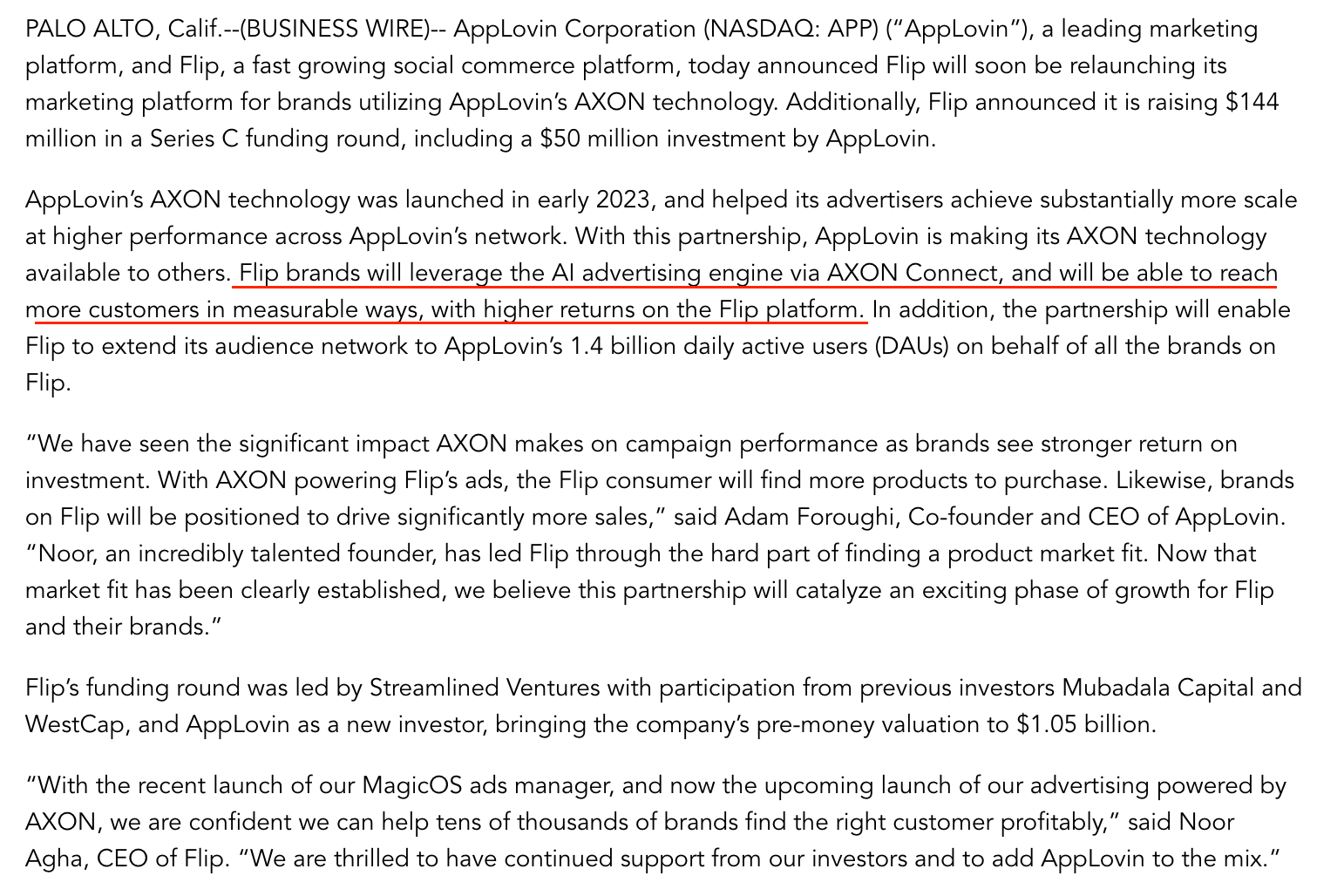

Flip's user growth through 2024 was spurred by a growth investment financing round that included AppLovin as an investor, as well as Flip's adoption of AppLovin's AXON platform, announced in April, 2024.

PALO ALTO, Calif.--(BUSINESS WIRE)– AppLovin Corporation (NASDAQ: APP) (“AppLovin”), a leading marketing platform, and Flip, a fast growing social commerce platform, today announced Flip will soon be relaunching its marketing platform for brands utilizing AppLovin’s AXON technology. Additionally, Flip announced it is raising $144 million in a Series C funding round, including a $50 million investment by AppLovin.

AppLovin’s AXON technology was launched in early 2023, and helped its advertisers achieve substantially more scale at higher performance across AppLovin’s network. With this partnership, AppLovin is making its AXON technology available to others. Flip brands will leverage the AI advertising engine via AXON Connect, and will be able to reach more customers in measurable ways, with higher returns on the Flip platform. In addition, the partnership will enable Flip to extend its audience network to AppLovin’s 1.4 billion daily active users (DAUs) on behalf of all the brands on Flip.

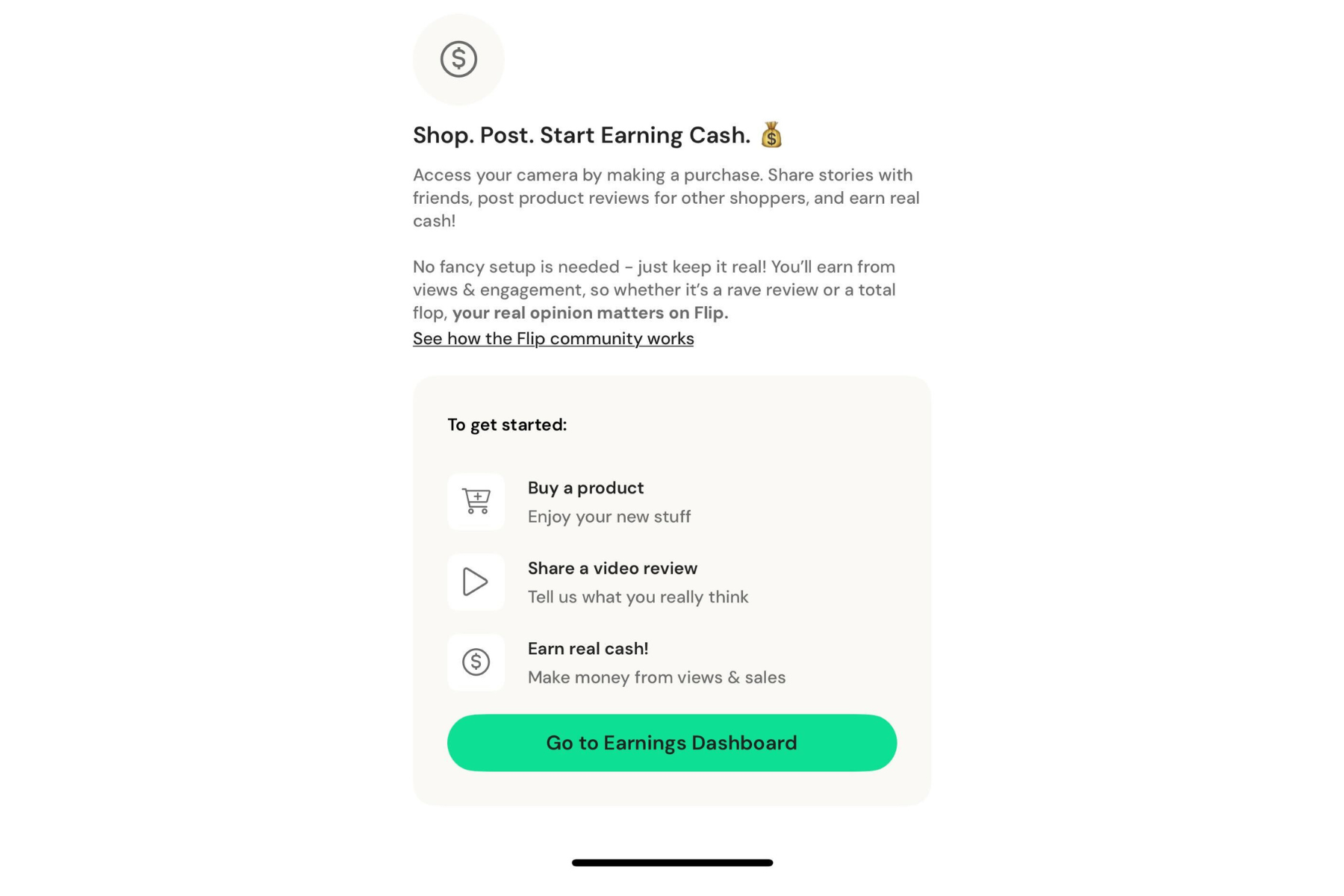

On the surface Flip may sound innocuous enough. Consumers can leave product reviews for e-commerce goods they buy, and then monetize their product review videos with "Creator Earnings" as cash payouts or in-platform "Flip Cash" coupons for discounts on products bought through Flip.

This YouTube video is a great, short overview of Flip. Posted under a month ago, on January 20, 2025.

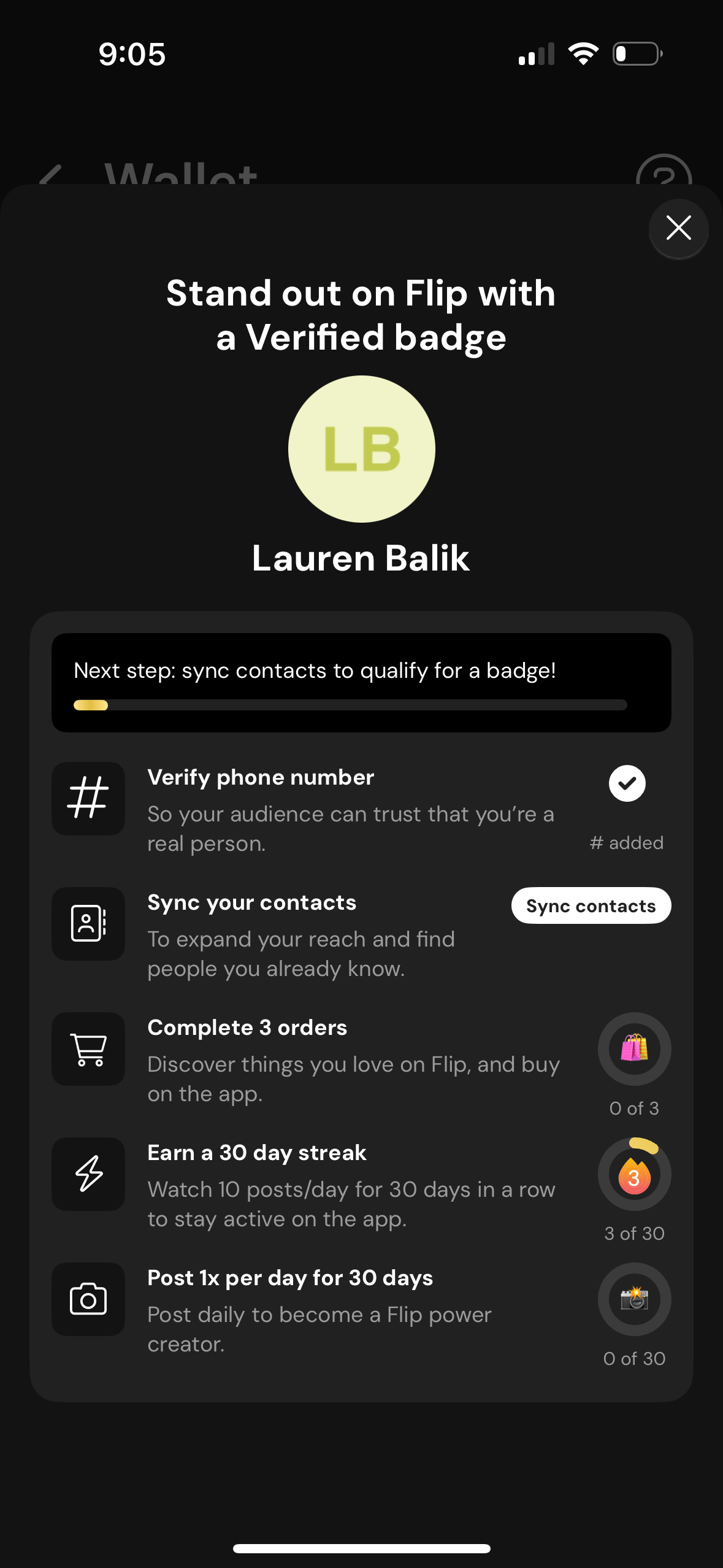

1) Recruitment Incentives Prioritized vs. Sales Incentives

Flip's biggest incentive to get users to join has been the payouts they offer to users for syncing phone contacts and referring others. As of late 2023, per the below Los Angeles Times article, consumers were incentivized with payments of $130 if they synced or shared the contact info of friends.

A separate, more casual lifestyle piece from November 2023 in The Free Press tells the story of selling contacts for Flip coupons/discounts.

In fact, Flip's incentives for simply recruiting people into the scheme are outsized compared to the incentives for actually shopping on the app.

Flip's approach to recruiting users by collecting phone numbers has gotten so out of hand that in recent months there have been two lawsuits already for spam texting as violations of the Telephone Consumer Protection Act (TCPA).

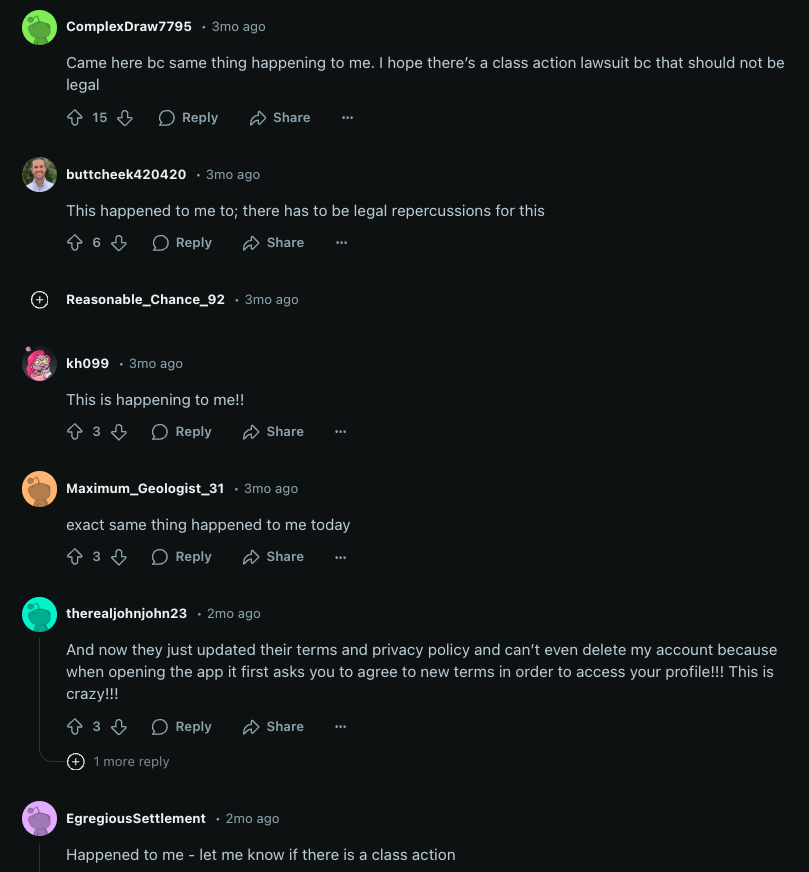

Flip's users have also recently become frustrated with the recruiting requirements and spam SMS.

@amateurhourgardening Let’s talk about Flip’s new verification process. To fully verify your account and unlock the friend referral feature, you now have to sync all of your contacts. I tried a partial sync, but it didn’t work—no referrals allowed. I’m skeptical about giving them my entire contact list. Why do they need that much information? Have you synced your contacts yet? What do you think are the pros and cons of this new requirement? Let’s discuss below. #FlipTips #VerificationProcess #SyncContacts #FlipCommunity #PrivacyConcerns #ShopAndEarn #FlipUpdates #FlipFinds #flipapp @Flip

♬ original sound - Deer Run Shop | Elizabeth Cole

A Flip user described Flip's requirement to sync contacts, in this TikTok post from January 26, 2025.

2) Requirement to Pay In Before Being Able to Make Money

Core to any pyramid scheme is the requirement to buy supplies or buy-in before one can earn money through recruitment and other activities. Flip is no different.

In order to post any content on Flip, a user must first make a purchase through Flip. Users cannot post any content, social or product reviews or otherwise, without first buying wares and running up sales transactions.

In order to become "Verified" on the platform and actually make money and have content prioritized, not only must a user sync all their phone contacts, but a user must complete 3 orders through Flip and make posts every day for 30 days.

3) Requirement to Buy New Products to Continue Participating in the Scheme as a Distributor

In order to post ongoing product reviews to make money, a user must buy every single product they wish to review from Flip itself. It's not possible to post a product review without purchasing the accompanying product from Flip, so users are already "in the hole" upon purchase and then must create content about the product so that they earn enough back from views and sales attribution from their content.

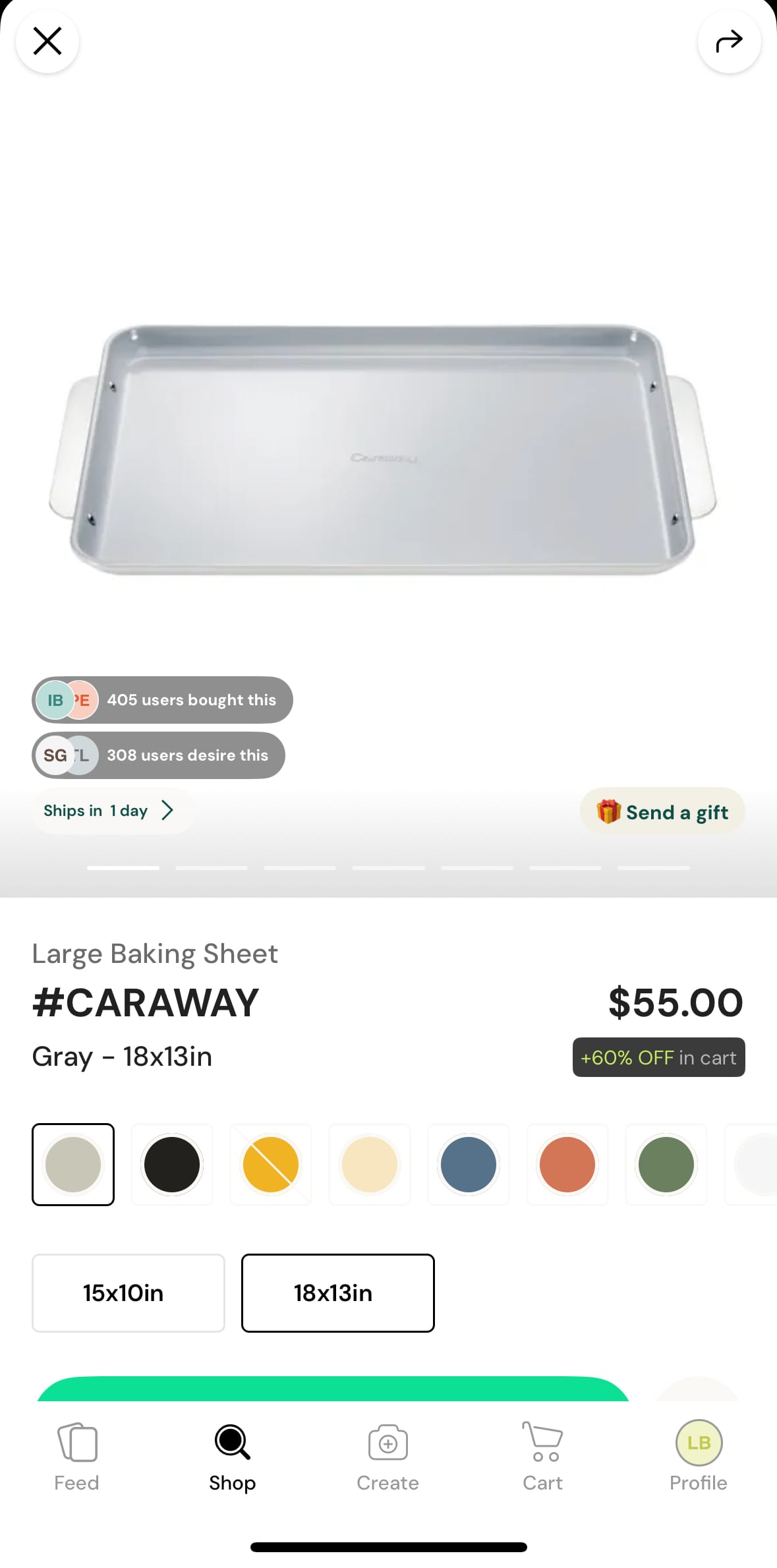

As a simple example, let's examine the Caraway Large Baking Sheet featured on Flip, a simple $55 baking sheet one may use in the home kitchen.

Everyone who is making content about this item would have had to buy this item first before making content, going $55 underwater (not including whatever coupons/discounts a user may have applied).

The problem is, there is only so much room to be one of the top videos reviews for any product. Only a few content creators will be able to make back the $55 from commissions and potentially turn a profit. Everyone else posting product reviews to make money on the Caraway baking sheet will have gone underwater on this item. Even if the good is 50% off with Flip discounts, that's $27.50 a Flip user who buys the product will have to make up to break even.

As shown below, several videos for the Caraway Baking Sheet were able to get in the tens of thousands of views and have a chance at generating sales attribution earnings, though the majority of users have very low view counts and a low chance of generating these content creators any return.

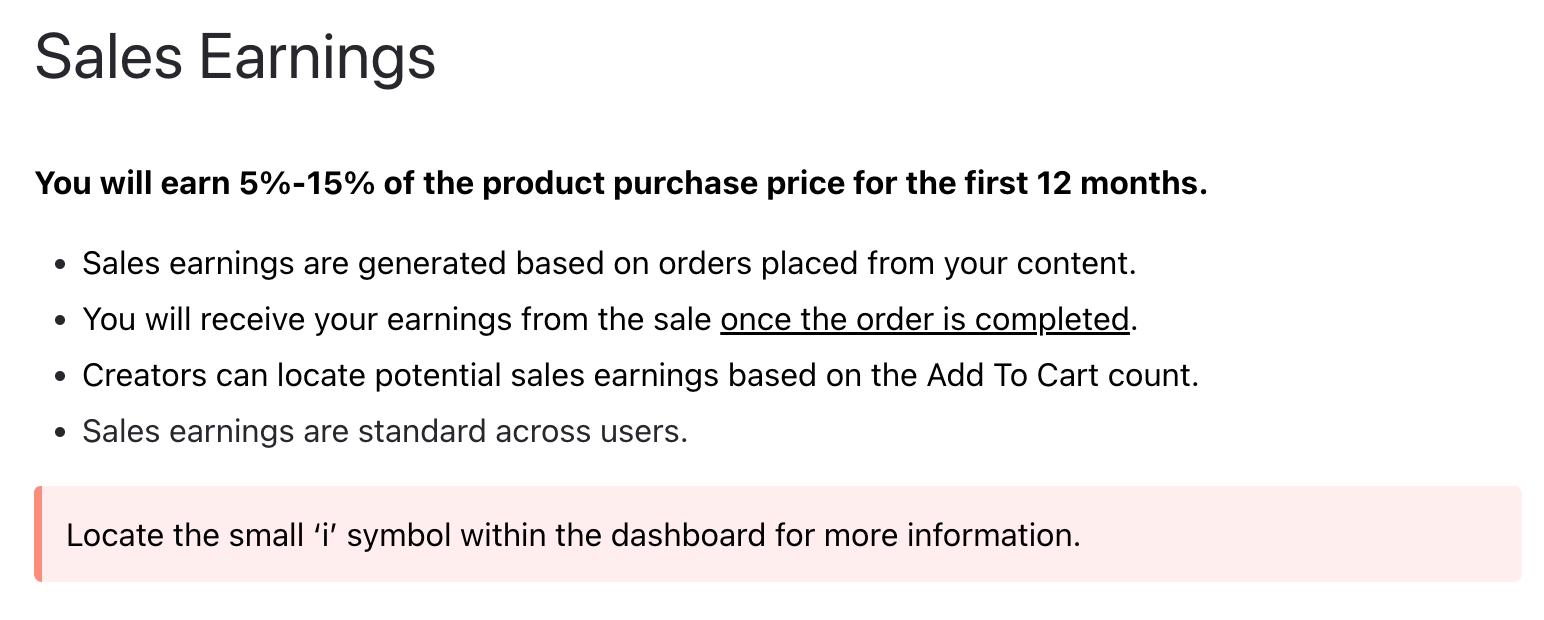

Per Flip's Knowledge Base, Flip creators can earn actual money back (not in-platform coupons/discounts) two ways:

-Sales Earnings: a 5-15% cut for every sale that came directly from a creator's video on Flip, for 12 months from the video posting date

-Engagement: $30 for every 1000 unique view that lasts 3 seconds or longer, for the first 30 days from the video posting date

At 5%, a creator needs 20 attributed sales to break even. At 15%, a creator needs 7 attributed sales to break even.

Plus, it's obvious when viewing the platform and scrolling through various products that the majority of Flip creators clearly do not even get 1000 3-second+ views on the content they create, and there's no real way for a user to audit the accuracy of how long a video was played.

It's clear that majority of Flip content creators are not breaking even, even if they are applying coupons and getting goods 20%, 30%, 50%+ off.

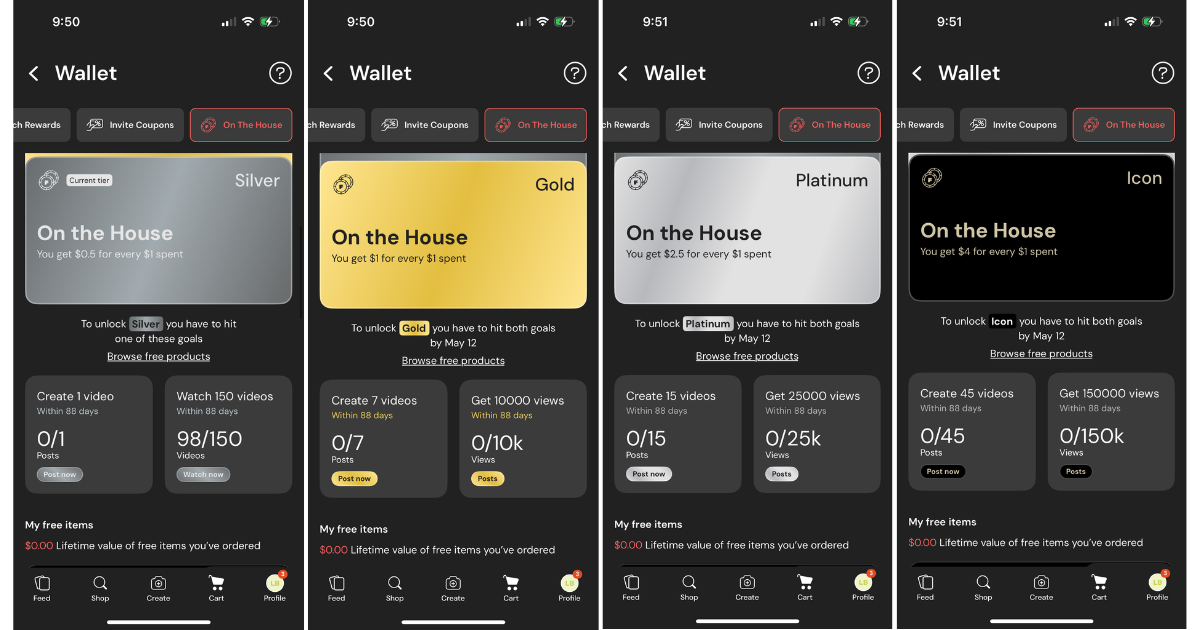

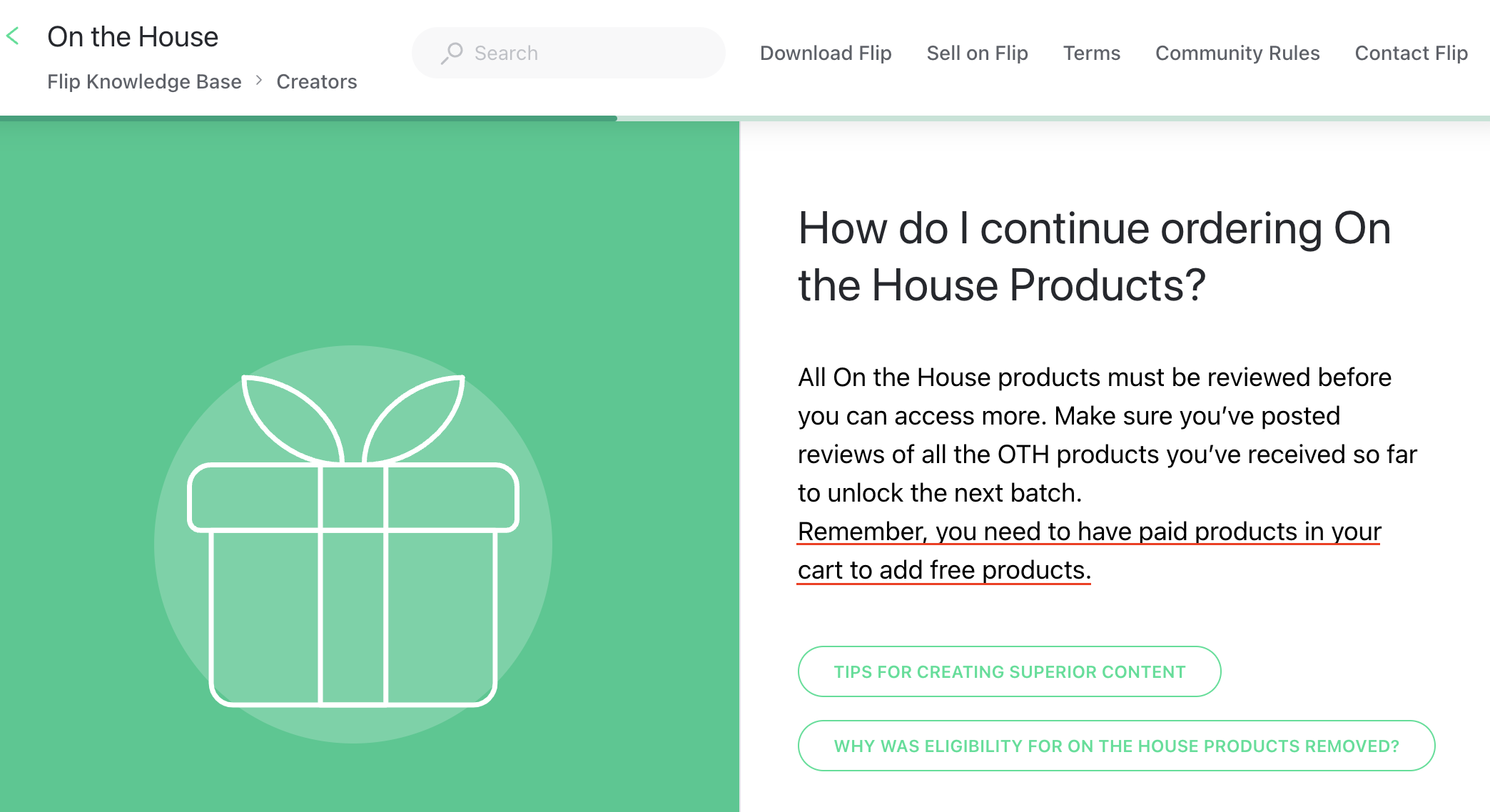

Additionally, Flip's "On The House" tier program promises users credits to use toward free products to use to make more review videos after clearing certain tiers, though these products are not truly free. In order to redeem "On the House" products with credits based on tiers, users still must include a paid product in the same cart checkout if a user wishes to apply credits to these "free" products.

This whole pyramid scheme does nothing but clear revenue for low-tier e-commerce brands while filling garages all across America with vape pens, cookware, cheap makeup, and all kinds of other Chinese crap nobody needs.

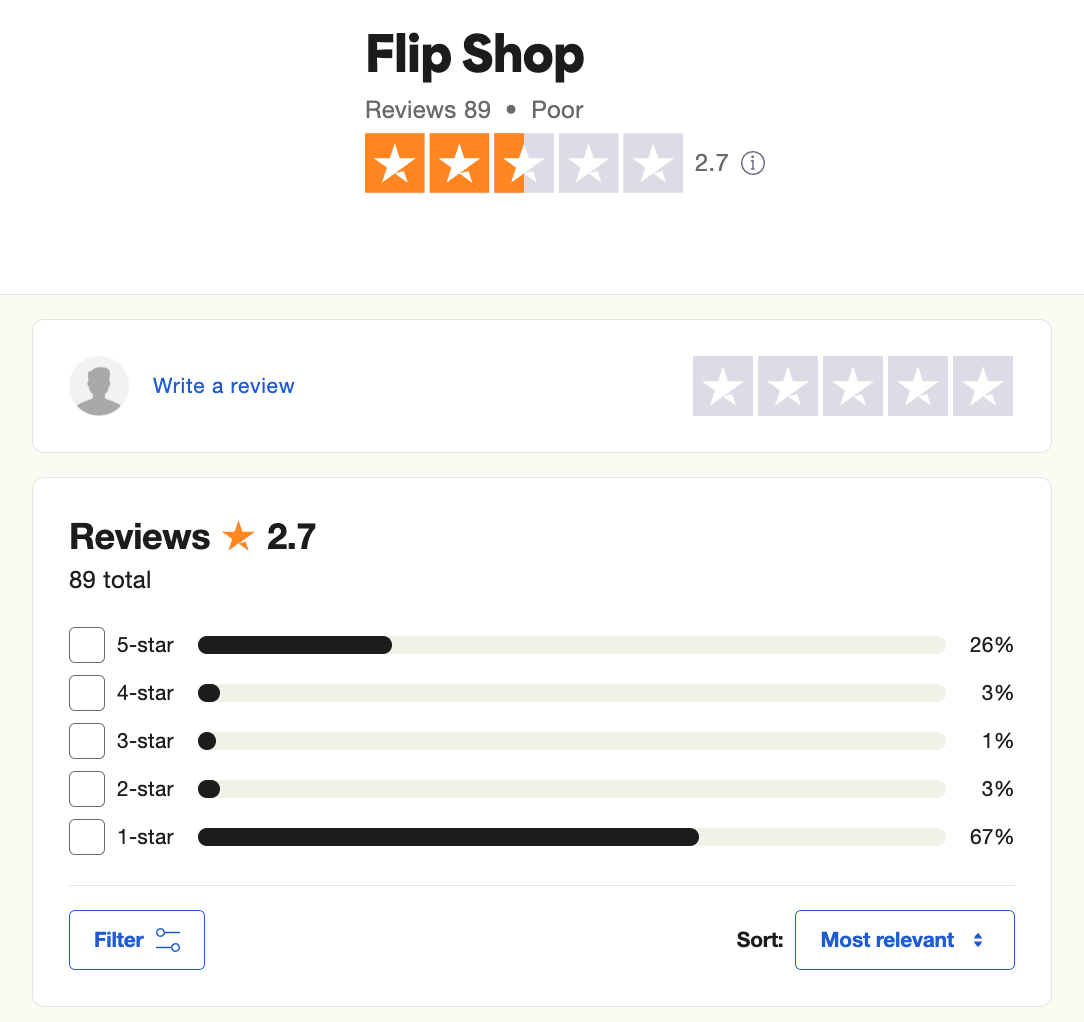

As with any pyramid scheme, nobody currently involved in the pyramid wants to discuss how most of the people involved "invest" more into the scheme than they take out. Yet, you can see the Flip reviews below at TrustPilot.

Or, you may review the "Flip math" going on, promoted by Flip, where $150 = $500 but the $150 is just coupons and is in no way, shape, or form equal to $500, not even in the ad itself!

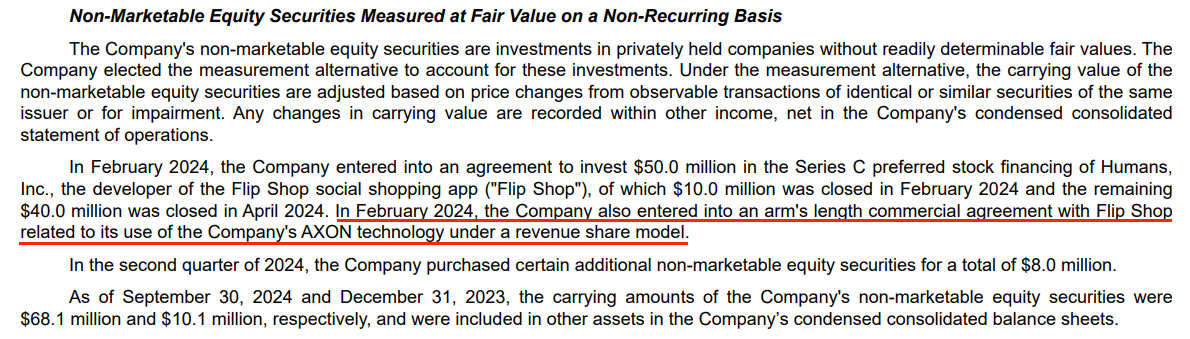

The Related Party Revenue Share

AppLovin is in a revenue share agreement with Flip from February 2024, based on AppLovin's currently available 10-Q's, meaning for items sold on Flip, which uses AppLovin's AXON, AppLovin gets a cut of revenue sold on Flip. AppLovin would then roll up this revenue into the Software Platform (now renamed Advertising) part of its financials.

Flip's COO/President Eduardo Vivas is on AppLovin's Board of Directors and his brother Rafael is an executive at AppLovin who was previously running AppLovin subsidiary game studio Lion Games.

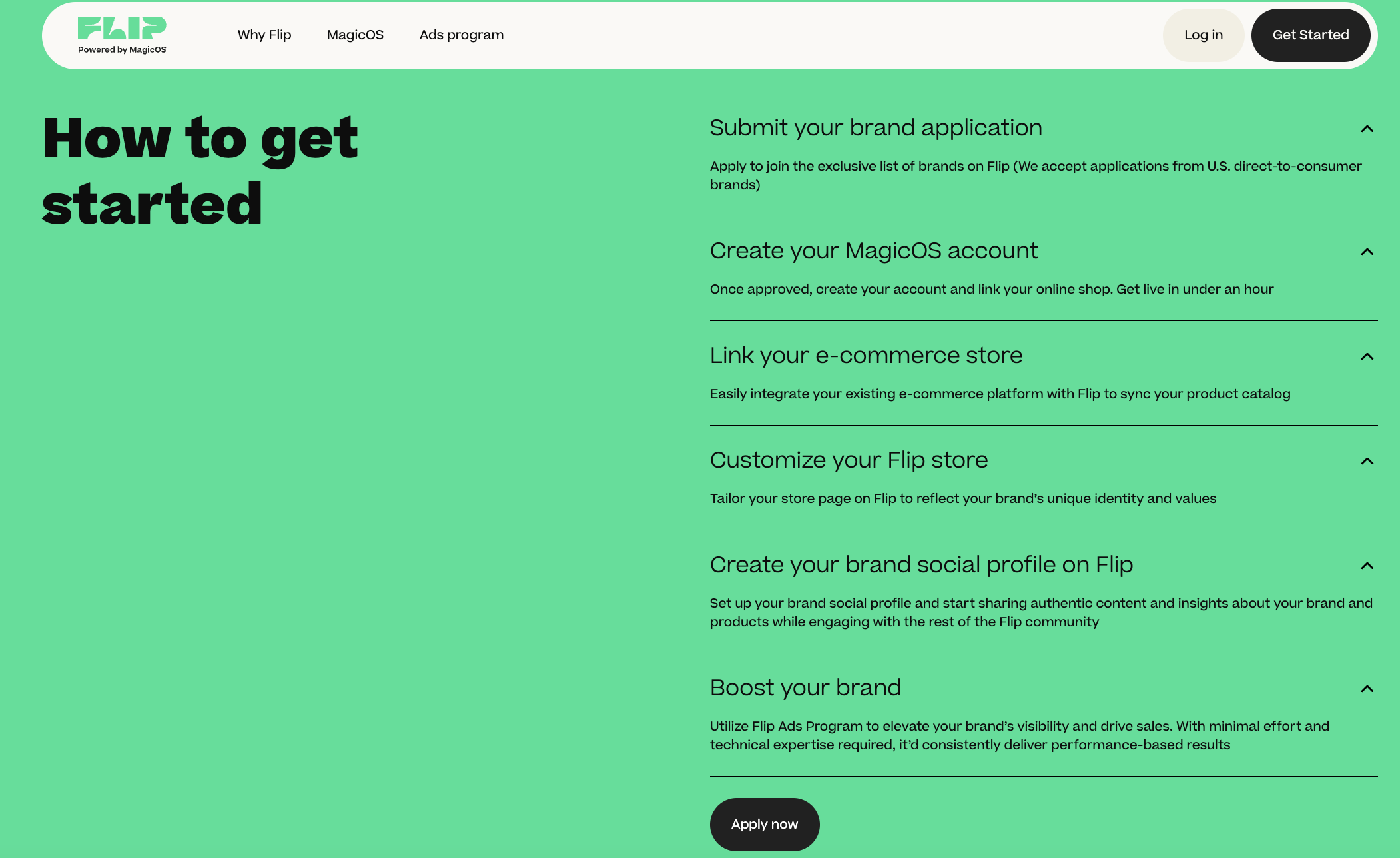

On the other side of the Flip business is not the consumer side, but the brand side.

The whole process for all the brands selling through Flip (and there are thousands of them per Flip) is as follows:

- Submit application

- Create MagicOS ad manager account to manage brand in Flip

- Link e-commerce store (to Shopify, BigCommerce, etc.)

- Customize Flip store

- Create brand profile

- Utilize Flip Ads Program to manage which videos on Flip get prioritized vs. de-prioritized for your brand

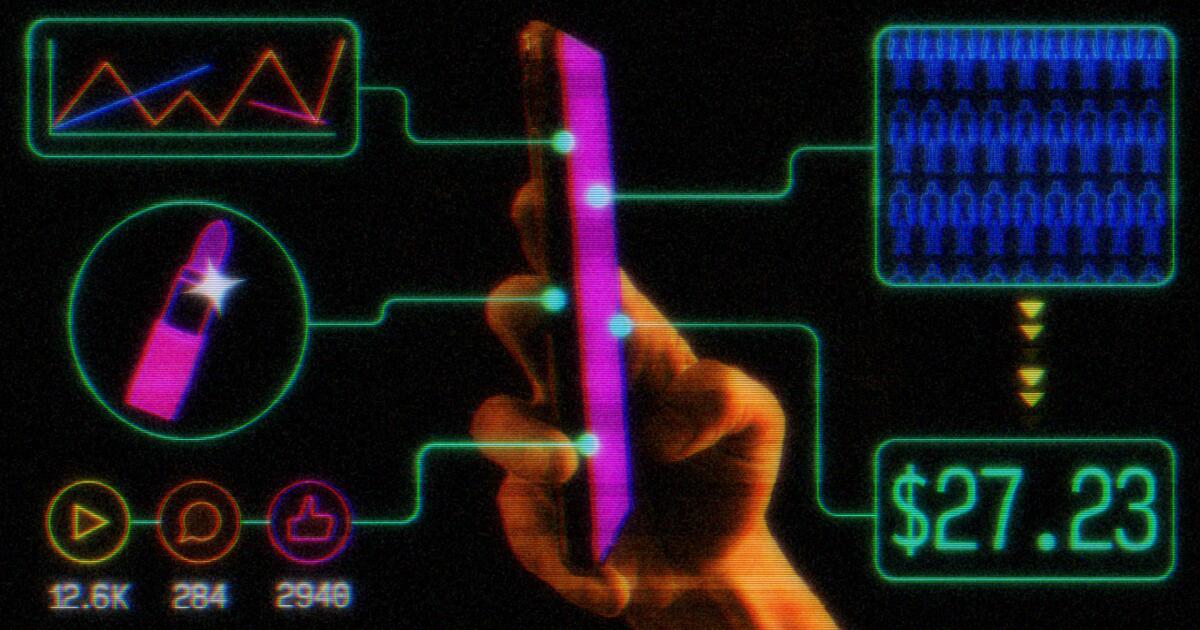

Remember: all of Flip is just ads. It's one big scroll through user-generated ads, and the more ads a consumer scrolls through, the more "money" one can (allegedly) make. The whole Flip platform is just one big scroll of user-generated ad after ad after ad after ad.

Additionally, all of the brands on Flip bid - via AppLovin's AXON "AI" technology via a revenue share to AppLovin - for priority to reach customers within the Flip platform.

... but is this "AI" or is this just a pyramid scheme shooting revenue over to AppLovin?

Per all public statements, Flip is not utilizing AppLovin for advertising Flip brands on other channels. Rather, Flip is using AppLovin's AXON within the Flip platform. After all, Flip is merely a scroll of ads (where users are incentivized to scroll through as much content as quickly as possible for coupon credits).

Thus, AppLovin's relationship with Flip is one of falsely attributing Flip's GMV to AppLovin AXON and AppLovin's "Advertising" bucket - which now claims credit for Flip in-platform content.

Flip is Going to Die Soon

Above data via public Sensor Tower app rankings. https://sensortower.com/

@rachel_and_tj Is Flip already done? #flip #flipapp #tiktokalternative #ContentCreator #TikTokShopAffiliate #TikTokShopForCreator

♬ original sound - Rachel & TJ

Let's Ballpark It

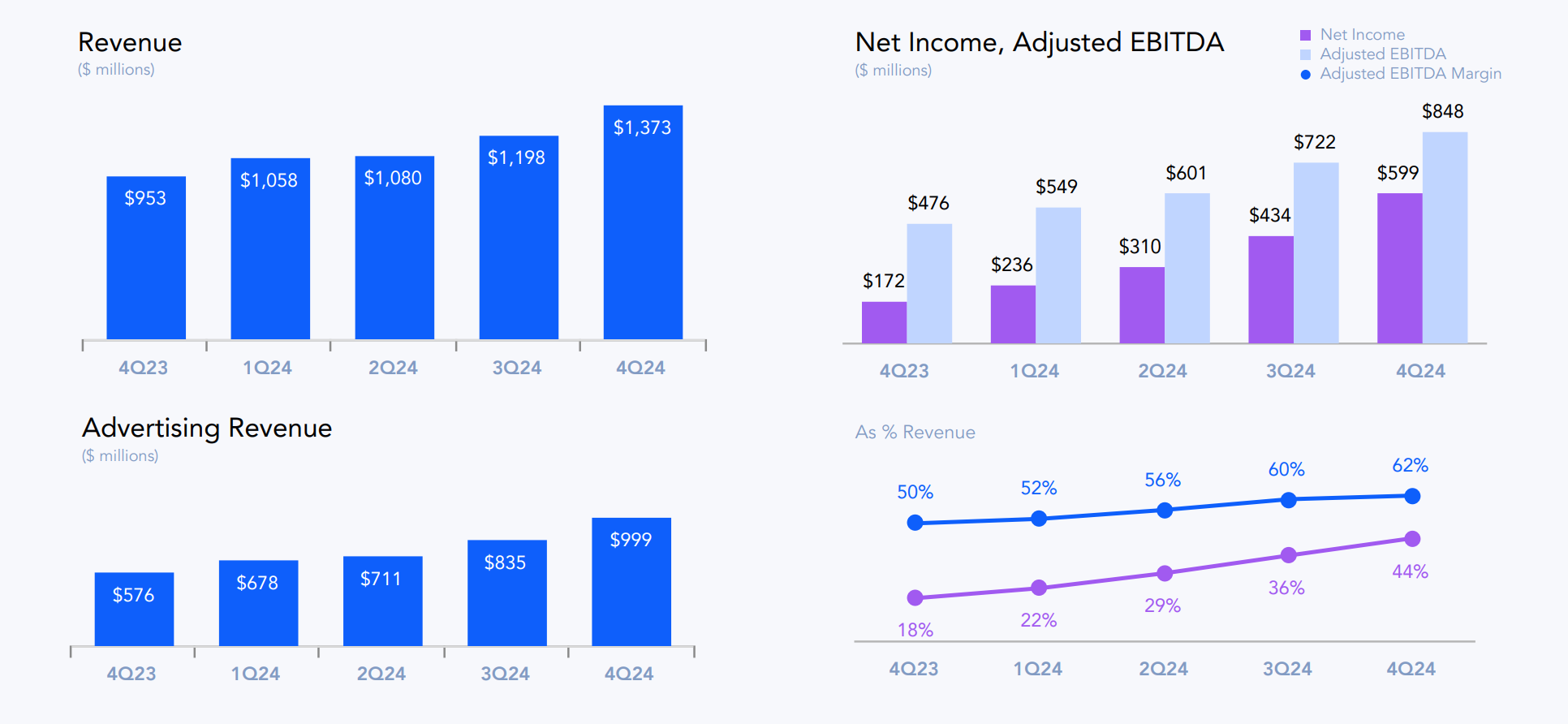

AppLovin released their supplemental 2024 numbers with accompanying Financial Results (we'll get the formal 10-K soon in the next few days or week).

All of this Flip revenue rolls up to "Advertising Revenue" as it's not part of AppLovin's in-house gaming studios.

At even 250k Flip users spending $100 per month that's $25M to Flip per month, or $75M per quarter at that run rate.

At 500k Flip users spending $100 per month that's $50M to Flip per month, or $150M per quarter at that run rate.

Yet these numbers are very conservative. Per an Adobe study published in September 2024 1 of 8 Americans had used Flip, and 58% of this group, or roughly 1 of 15 Americans used Flip once per week in 2024 (I believe this may be slightly too high).

It's obvious that Flip is clearly juicing AppLovin's revenue in 2024 when AppLovin adopted the "e-commerce story" for Wall Street but because Flip is a pyramid scheme with direct related party interests, AppLovin has avoided the question about how this pyramid scheme not only affects AppLovin's overall revenue, but revenue growth in the e-commerce category through late 2024 into 2025.

I believe it's obvious that at even a very small several percentage point revenue share Flip is clearly what is driving AppLovin "Advertising" revenue. In fact, given the stagnant growth in the mobile gaming industry, I believe Flip is the primary revenue growth story for AppLovin and that this pyramid scheme is about to collapse as too many consumers have been screwed over or lost money.

Really, we don't know the rev share cut off Flip's GMV that AppLovin is taking as free, pure margin credit, though we do know the person orchestrating this - Eduardo Vilas - is heavily invested in AppLovin as a Board member.

The main question is what is AppLovin's take rate off the Flip GMV? 2% 10%? 50%? 100%?

We don't have that answer because Flip is a pyramid scheme and AppLovin won't admit to how much they are taking off this related party pyramid scheme.

Caveat emptor

I maintain positions short AppLovin (NASDAQ: APP) and I believe this entire "e-commerce" fabrication not only needs more eyes on it, but that this fabrication is about to collapse. AppLovin made it clear multiple times on their recent earnings call that they will not break down revenue to the e-commerce vertical even though the e-commerce narrative is what is driving the stock price moves, and it's obvious that this is because a related party pyramid scheme is what is propping up AppLovin and CEO Arash Adam Foroughi will not and cannot admit this.

You won't hear this from the sell side. They'd rather stick their heads in the sand.

If you think this is stupid, it only gets stupider. This is a $35-$50 stock trading at over $500 per share because nobody wants to look at the related party pyramid scheme.

AppLovin (NASDAQ: APP) is an Extremely Strong Sell. AppLovin has outright refused to address anything as the Flip pyramid scheme implodes and becomes a cartoon of itself.

________

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Lauren Balik does not represent the interests of any fund or of any investor other than herself. Past performance is not indicative of future results. This content speaks only as of the date published. Any projections, estimates, forecasts, targets, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.